Decoding the USD to INR Dance | Why Your Wallet Feels the Beat

USD INR Ever wondered why that online shopping cart total seems to change every few minutes? Or why your cousin working in the US sends back a different amount each month, even if his salary stays the same? The answer, my friend, lies in the fascinating – and sometimes frustrating – world of USD to INR conversion rates.

Thank you for reading this post, don't forget to subscribe!Forget dry economics textbooks. Let’s break down what’s really going on and, more importantly, why you should care. I initially thought understanding currency exchange was just for finance geeks. But then I realized it impacts everything from the price of your phone to your dream vacation. So, buckle up; we’re diving in!

Why Does the USD to INR Rate Fluctuate Like a Mumbai Local Train Schedule?

Here’s the thing: it’s not some random number generator at work. The Indian rupee and the US dollar are constantly reacting to a complex ballet of Global economic forces.

Think of it like this: imagine a tug-of-war between India and the US, with factors like inflation, interest rates, and political stability pulling the rope.

One of the biggest players is the supply and demand game. If more people want to buy Indian rupees (maybe because India’s economy is booming), the price of the rupee goes up relative to the dollar.

Conversely, if everyone’s selling rupees like they’re going out of style, the rupee weakens. But it gets more complex. India’s foreign exchange reserves and economic growth play a vital role, as well as the stability of the government.

Another crucial aspect is interest rate differentials. If India offers higher interest rates than the US, investors might flock to India, increasing demand for the rupee.

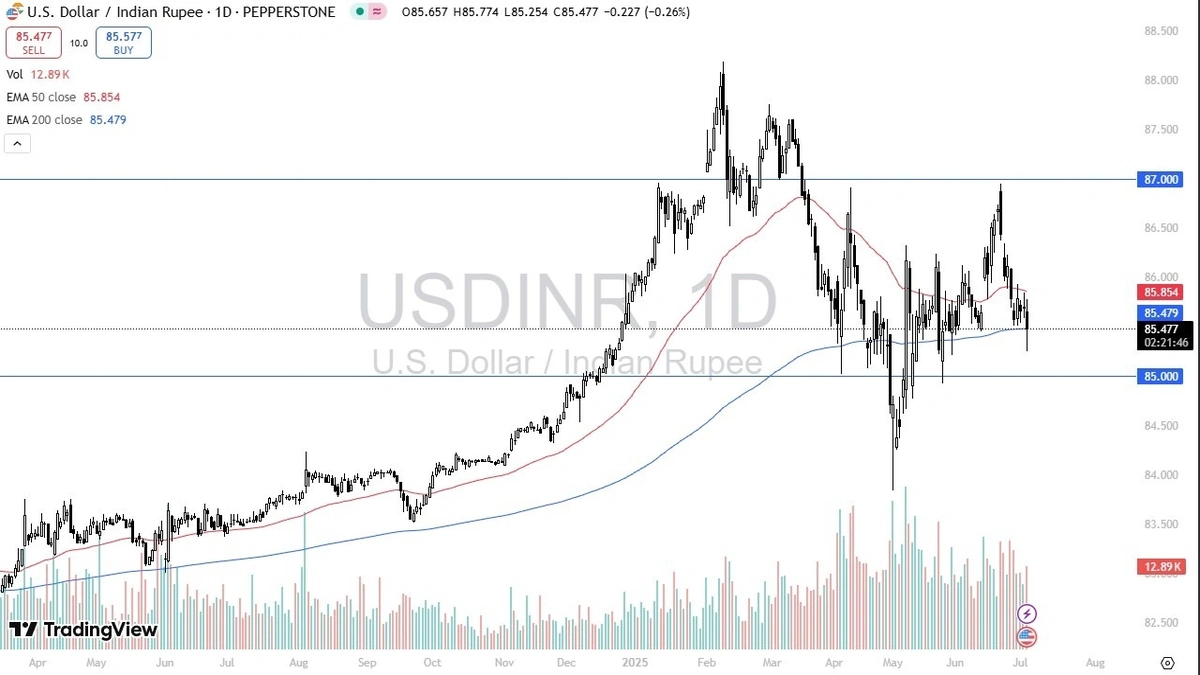

The Reserve Bank of India (RBI) also plays a role, intervening in the market to manage volatility and keep things somewhat stable (though, let’s be honest, “stable” is a relative term in this context).

And then there are the unexpected events – geopolitical tensions, natural disasters, global pandemics – that can send the market into a frenzy. Basically, the INR exchange rate is a sensitive indicator of global financial health and is constantly changing due to many factors.

Usd Inr How a Strong or Weak Rupee Impacts Your Chai and Samosas (and Everything Else)

So, why should you, the average Indian, care about all this economic mumbo jumbo? Because it directly affects your pocket! Let’s break it down:

Imports Get Pricier (or Cheaper): A weaker rupee means imports – everything from iPhones to crude oil – become more expensive. This leads to higher prices for consumers. Think of it this way: your favourite imported chocolate bar suddenly costs more because it takes more rupees to buy the same amount of dollars to pay for it.

Exports Get a Boost (in Theory): A weaker rupee can make Indian exports more competitive on the global market. But, and this is a big but, it depends on whether Indian companies can actually ramp up production and take advantage of the opportunity. Energy sector of India can impact the rupee value.

Overseas Travel Costs More (Ouch!): Planning a trip to Disneyland? A weak rupee means you’ll need more rupees to buy those precious US dollars for your flights, hotels, and Mickey Mouse ears. Your travel budget just took a hit. The impact of global market conditions on exchange rates often makes travel more or less expensive.

Remittances Change: For those receiving money from relatives working abroad, a weaker rupee can be a good thing. The same amount of dollars translates into more rupees, increasing their purchasing power. I remember my uncle working in Dubai used to eagerly track the exchange rates before sending money home.

Navigating the USD to INR Rollercoaster | Tips for the Savvy Indian

Okay, so you can’t control the global economy. But you can make smarter decisions to protect yourself from the wild swings of the currency market. Here are a few things I’ve learned (sometimes the hard way):

Plan Ahead for Big Purchases: If you’re planning a major purchase involving foreign currency (like that new gadget or that international trip), keep an eye on exchange rates and try to buy when the rupee is relatively strong. The key is observation and foresight.

Consider Currency Hedging (for Businesses): If you run a business that deals with international transactions, explore currency hedging strategies to minimize your risk from exchange rate fluctuations. Talk to your bank or a Financial advisor. I am not a financial advisor and this isn’t financial advice; it is for educational purposes.

Diversify Your Investments: Don’t put all your eggs in one basket. Consider diversifying your investments across different asset classes and currencies to reduce your overall risk. Again, talk to a qualified professional.

Stay Informed: Keep up-to-date with economic news and developments that could impact the USD to INR exchange rate. Knowledge is power! And speaking of knowledge, owning your own business could be a smart financial move.

The Future of the Rupee | Crystal Ball Gazing (with a Grain of Salt)

Predicting the future of the rupee dollar rate is a fool’s game. There are just too many variables at play. But here are a few trends to watch:

India’s Economic Growth: If India continues on its path of rapid economic growth, it could attract more foreign investment and strengthen the rupee. The nation’s economic indicators are positive, and investment opportunities abound.

Global Economic Conditions: A global recession could weaken the rupee as investors flock to safe-haven currencies like the US dollar. The strength of the US economy has a large impact on global markets.

RBI Policy: The RBI’s monetary policy decisions will continue to play a crucial role in managing the rupee’s value. The RBI monetary policy is always something worth keeping an eye on.

Frequently Asked Questions (FAQ)

What if I need to send money to India from abroad?

Compare exchange rates and fees from different money transfer services to get the best deal.

What if I’m travelling to the US? When should I exchange my rupees?

Keep an eye on exchange rates and exchange your rupees when the rupee is relatively strong against the dollar. Consider using a travel credit card with no foreign transaction fees.

What if the USD to INR rate suddenly spikes?

Don’t panic! It’s usually a temporary fluctuation. Avoid making any rash decisions based on short-term movements.

What if I’m an investor? How does this impact my portfolio?

Consult with a financial advisor to understand how currency fluctuations affect your investment portfolio and to develop a suitable hedging strategy.

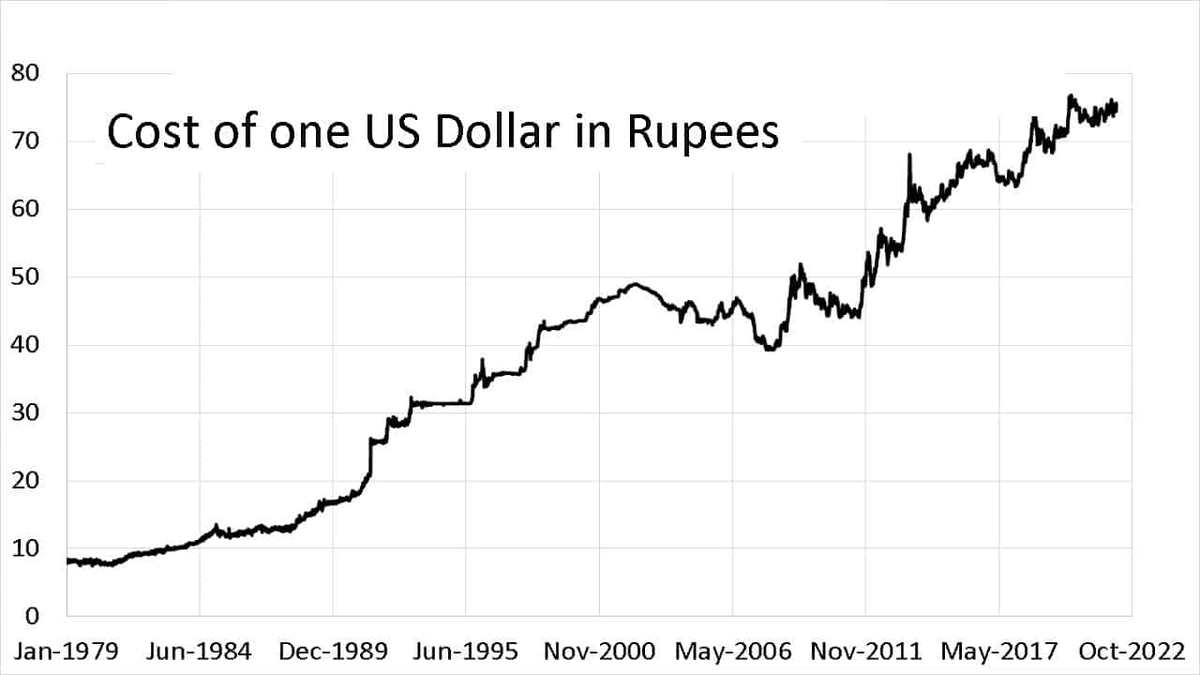

What about long-term trends in the USD to INR value?

Generally, emerging economies’ currencies like the INR tend to depreciate over time against stronger currencies like the USD, but short term fluctuations can vary greatly.

Ultimately, understanding the dynamics of the USD to INR exchange rate is like learning a new dance. It takes time, patience, and a willingness to adapt to the ever-changing rhythm of the market. And remember, while you can’t control the music, you can learn to dance better.