Smart Budgeting Tips for Families ,Save More Monthly.

Budgeting tips for families Managing a family’s finances can feel overwhelming, with expenses piling up from groceries, school supplies, extracurricular activities, and unexpected emergencies. A well-crafted budget acts as a roadmap, guiding families toward financial stability while allowing room for enjoyment. This guide provides practical, actionable budgeting tips tailored for families, helping you save money, reduce stress, and work toward shared goals like vacations, education funds, or debt repayment. With a clear plan, you can take control of your finances and build a secure future.

Thank you for reading this post, don't forget to subscribe!Budgeting tips for families Why Budgeting Matters for Families?

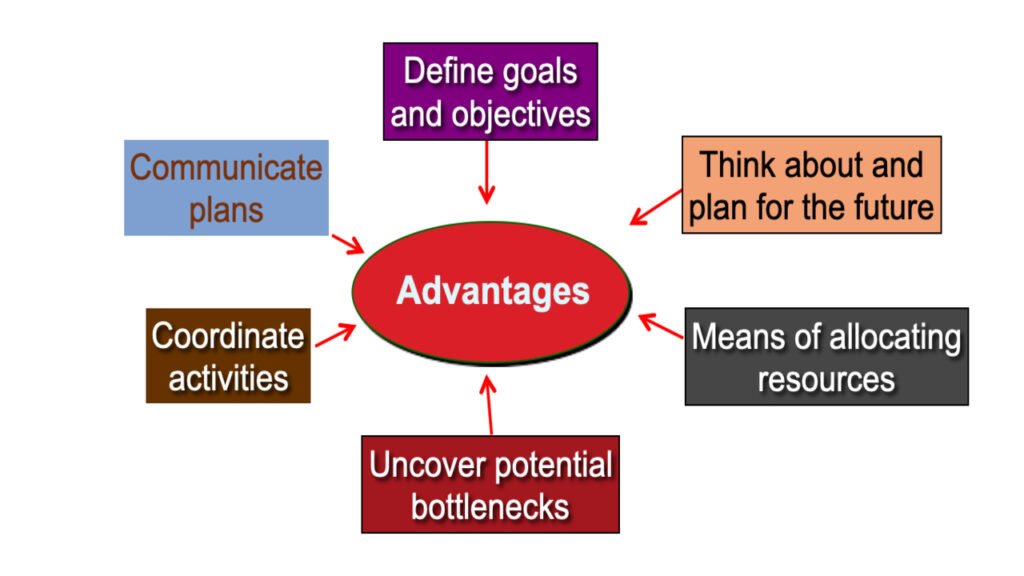

A budget is more than numbers on a spreadsheet; it’s a tool that aligns your spending with your priorities. For families, budgeting is crucial because expenses can multiply quickly, and financial decisions impact everyone in the household. A thoughtful budget fosters security, encourages teamwork, and prepares you for life’s unpredictability.

Promoting Financial Security

A budget helps you allocate funds for emergencies, retirement, or your children’s future. Consistent savings, even small amounts, can grow into a robust safety net over time, protecting your family from financial strain.

Reducing Stress and Conflict

Money disputes are a common source of tension in families. A transparent budget encourages open communication, aligns everyone on shared goals, and reduces anxiety by providing clarity and control.

Teaching Financial Responsibility

Involving kids and teens in budgeting tips for families teaches them valuable money management skills. From allowances to saving for college, early lessons in budgeting set them up for lifelong financial success.

Step 1: Assess Your Income and Expenses

To create an effective budget, start by understanding your financial picture. Gather all income sources and track every expense to see where your money goes.

Calculate Total Income

Include all reliable income, such as salaries, freelance earnings, child support, or side hustles. For variable income, use an average from the past six months to create a realistic baseline. Tools like pay stubs or bank statements can help.

Track and Categorize Expenses

List all expenses, dividing them into fixed (rent, utilities, insurance) and variable (groceries, entertainment) categories. Don’t overlook irregular costs like annual subscriptions, holiday gifts, or car maintenance. Use apps like Mint, YNAB, or a simple spreadsheet to monitor spending for a month. This reveals patterns and areas to adjust.

Step 2: Set Clear Financial Goals

Goals give your budgeting tips for families purpose. Involve the whole family to ensure everyone feels invested. Divide goals into short-term (achievable within a year) and long-term (over several years).

Short-Term Goals

These might include building a $1,000 emergency fund, paying off a credit card, or saving for a family vacation. Short-term goals keep you motivated with quick wins.

Long-Term Goals

Think bigger—saving for a home down payment, funding college, or preparing for retirement. Break these into smaller milestones, like saving $5,000 annually toward a $20,000 goal.

Step 3: Choose a Budgeting Method

With income, expenses, and goals mapped out, select a budgeting method that suits your family’s lifestyle. Two popular approaches work well for families.

The 50/30/20 Rule

Allocate 50% of income to needs (housing, food, utilities), 30% to wants (dining out, hobbies), and 20% to savings or debt repayment. This simple framework is ideal for busy families who want flexibility without micromanaging every dollar.

Zero-Based Budgeting

Assign every dollar a specific purpose—bills, savings, or fun—until your income minus expenses equals zero. This method suits families who want detailed control and are willing to invest time in planning.

Step 4: Cut Costs Without Sacrificing Joy

Reducing expenses doesn’t mean cutting out fun. Strategic cuts can free up cash while keeping family life enjoyable.

Shop Smart for Groceries

Groceries are a major expense, but meal planning can save hundreds monthly. Create weekly menus, buy in bulk, and choose store brands. Use apps like Flipp or Ibotta to find deals, and batch cook to stretch ingredients. Involving kids in planning meals can also teach them budgeting basics.

Trim Subscriptions

Review streaming services, gym memberships, and app subscriptions. Cancel unused ones or share costs with friends or family. For example, splitting a Netflix family plan can halve the cost.

Embrace Free Activities

Family fun doesn’t have to be expensive. Visit parks, libraries, or community centers for free events. Host game nights, movie marathons, or potlucks instead of costly outings. Check local websites for free festivals, museum days, or outdoor concerts.

Step 5: Involve the Whole Family

A budget succeeds when everyone participates. Engaging kids and spouses creates accountability and shared purpose.

Teach Kids About Money

Give young kids small tasks, like tracking their allowance or saving for a toy. For teens, introduce budgeting for gas, clothes, or phone bills. Apps like Greenlight or games like Monopoly make learning fun. Discussing family goals, like saving for a vacation, helps kids understand the “why” behind budgeting.

Hold Family Budget Meetings

Schedule monthly check-ins to review progress, celebrate wins, and adjust plans. Keep discussions positive, focusing on solutions rather than blame. Encourage everyone to share ideas for saving or earning extra income.

Step 6: Build an Emergency Fund

Unexpected expenses—like car repairs or medical bills—can derail your budgeting tips for families. An emergency fund acts as a buffer, keeping you on track.

Start Small

Aim for $500-$1,000 initially, then build toward 3-6 months of living expenses. Even $25-$50 a month adds up. Automate transfers to a savings account to stay consistent.

Keep It Accessible

Store your emergency fund in a high-yield savings account for easy access and modest growth. Avoid dipping into it for non-emergencies, like impulse purchases.

Step 7: Tackle Debt Strategically

Debt can weigh heavily on family finances. Prioritize paying it off while maintaining other goals.

Use the Snowball or Avalanche Method

The snowball method focuses on paying off the smallest debt first for quick wins, while the avalanche method targets high-interest debt to save money long-term. Choose what motivates your family most.

Negotiate Bills and Rates

Call service providers to negotiate lower rates on utilities, internet, or insurance. If you have credit card debt, ask for a lower interest rate or explore balance transfer cards with 0% intro APR.

Step 8: Plan for Big Expenses

Families face recurring big-ticket items—school supplies, holidays, or home repairs. Planning ahead prevents budget shocks.

Create Sinking Funds

Set aside small amounts monthly for predictable expenses, like $50 for holiday gifts or $30 for back-to-school supplies. By December or August, you’ll have enough without scrambling.

Shop Secondhand

Buy gently used clothes, sports gear, or furniture from thrift stores, consignment shops, or online marketplaces like Facebook Marketplace. This stretches your budgeting tips for families while reducing waste.

Step 9: Boost Income When Possible

If cutting costs isn’t enough, look for ways to increase income without overwhelming your family.

Side Hustles for Parents

Consider flexible gigs like freelancing, tutoring, or selling unused items online. Even a few hours a week can fund savings or debt repayment.

Encourage Teen Contributions

If you have teens, part-time jobs or chores for extra allowance can teach responsibility and ease budget pressure. They might contribute to their own phone bill or activities.

Step 10: Monitor and Adjust Regularly

A budgeting tips for families isn’t set-it-and-forget-it. Life changes—new jobs, growing kids, or unexpected costs—require flexibility.

Review Monthly

Check your budget monthly to see what’s working and what isn’t. Adjust for overspending or new priorities, like a child’s new hobby.

Use Technology

Apps like EveryDollar or PocketGuard simplify tracking. Set alerts for bill due dates or overspending to stay proactive.

Common Budgeting Pitfalls to Avoid

Even the best budgets can hit snags. Watch out for these traps.

Overspending on Wants

It’s tempting to splurge on dining out or toys, but stick to your 50/30/20 or zero-based plan. Small indulgences are fine, but overspending can derail savings.

Ignoring Small Expenses

Coffee runs or impulse buys add up. Track these “leaks” and redirect that money toward goals.

Forgetting Irregular Expenses

Annual fees, car registrations, or holiday gifts can sneak up. Include them in your budgeting tips for families to avoid surprises.

Benefits of Budgeting as a Family

A well-executed budget does more than save money—it strengthens your family.

Stronger Relationships

Shared goals and open communication build trust and teamwork. Budgeting together can turn financial stress into a bonding experience.

Financial Freedom

By cutting unnecessary expenses and paying off debt, you free up money for what matters—family trips, education, or a comfortable retirement.

Empowering Kids

Teaching kids to budgeting tips for families prepares them for independence. They learn to prioritize, save, and make thoughtful choices.

FAQs

1. How do I start budgeting with a tight income?

Focus on needs first (housing, food), then allocate small amounts to savings. Cut non-essentials like subscriptions and explore side hustles.

2. Should kids be involved in budgeting?

Yes! Age-appropriate tasks, like tracking allowances or discussing family goals, teach kids responsibility and make budgeting a team effort.

3. What’s the best budgeting app for families?

Apps like YNAB, Mint, or EveryDollar are great for tracking expenses and setting goals. Choose one with a user-friendly interface for your family.

4. How much should we save for emergencies?

Start with $500-$1,000, then aim for 3-6 months of expenses. Save what you can, even if it’s $20 a month.

5. Can budgeting still allow for fun?

Absolutely! budgeting tips for families for “wants” like family outings, and seek free activities like park visits or library events to keep costs low.