Decoding PPP | Why It Matters & How It Impacts You

PPP. You’ve probably heard the term thrown around, especially in the context of economics, finance, or even government projects. But what is it, really? And more importantly, why should you, sitting here in India, care about it? Let’s be honest, economic jargon can be a real snooze-fest.

Thank you for reading this post, don't forget to subscribe!But trust me, understanding PPP is like unlocking a secret code to understanding Global economics and development.

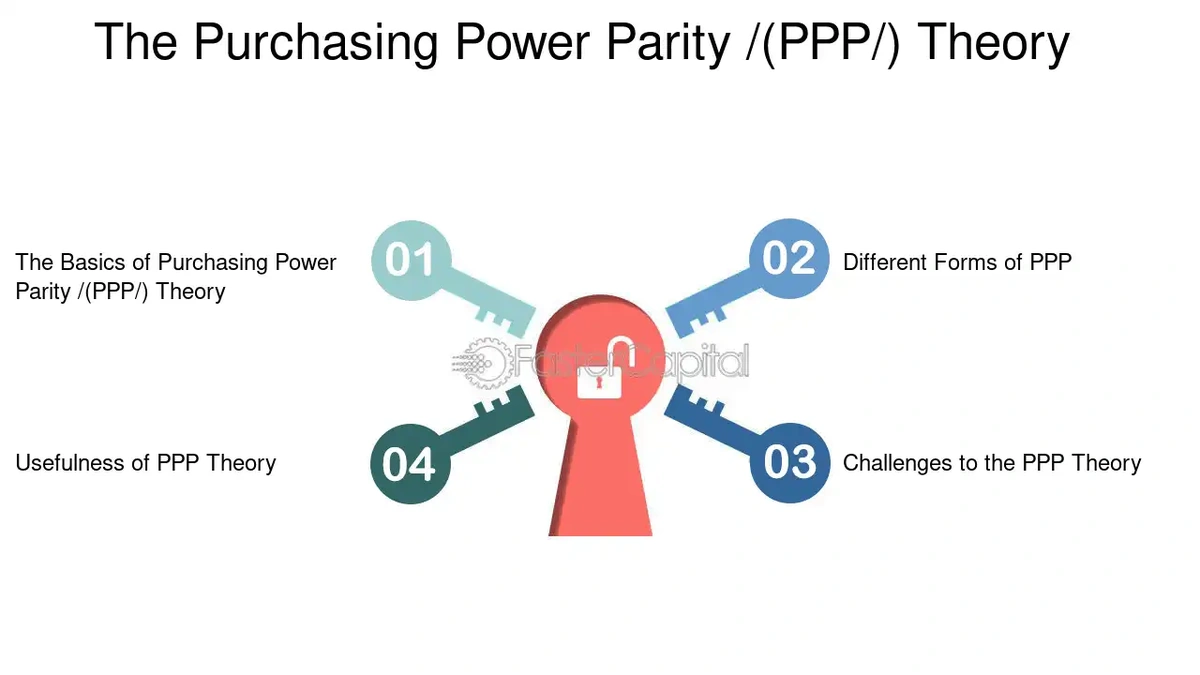

The thing is, Purchasing Power Parity (PPP) isn’t just some abstract concept cooked up by economists in ivory towers. It’s a vital tool for comparing economic productivity and standards of living between countries.

And, in a globalized world, understanding how India stacks up against other nations economically is crucial for everything from investment decisions to government policy.

What Exactly IS Purchasing Power Parity?

Okay, let’s break it down in plain English. Imagine you want to buy a Big Mac. In the US, it might cost $5. But in India, it might cost ₹250 (which, at an exchange rate of ₹80 to the dollar, is about $3.12). Sounds like India is cheaper, right? But PPP says, “Hold on a minute!”

PPP basically argues that exchange rates should eventually adjust to equalize the purchasing power of different currencies.

In other words, a basket of goods (like our Big Mac example) should cost roughly the same in different countries when measured in a common currency. What fascinates me is how it attempts to correct for the artificial distortions created by fluctuating exchange rates.

Let me rephrase that for clarity: if things are cheaper in one country, people will buy more there, driving up demand and prices until they equalize with prices in other countries.

It’s an idealized concept, of course, but it gives us a much clearer picture of relative economic strength than simple exchange rates alone.

The ‘Big Mac Index’ and Other Fun Ways to Understand PPP

The Economist magazine popularized the idea of using a Big Mac as a benchmark for PPP with its famous “Big Mac Index.” It’s a lighthearted but surprisingly insightful way to see whether currencies are at their “correct” level. But, the Big Mac Index isn’t the only tool.

Economists use much more sophisticated baskets of goods and services to calculate PPP rates. Data from organizations like the World Bank and the International Monetary Fund (IMF) provide comprehensive PPP data for countries around the globe.

According to the latest data from the World Bank, India’s PPP is significantly higher than its nominal GDP, indicating a large potential for economic growth.

Why PPP Matters for India | A Deep Dive

So, why should you care about all this? Well, here’s the thing: PPP gives us a more accurate picture of India’s economic size and the standard of living of its citizens. Nominal GDP (Gross Domestic Product) – the one you usually see in the news – is calculated using current exchange rates.

But this can be misleading. India’s nominal GDP might be lower than some other countries, but its PPP-adjusted GDP is often much higher, reflecting the fact that things are generally cheaper in India.

Consider this: if you earn ₹30,000 a month in India, you can probably buy a lot more goods and services than someone earning the equivalent in dollars in, say, New York City. That’s because the cost of living is lower in India. PPP takes this into account, providing a more realistic comparison of living standards.

Furthermore, understanding PPP is vital for:

- International Comparisons: Comparing India’s economic performance with other nations in a meaningful way.

- Investment Decisions: Helping businesses make informed decisions about where to invest and expand.

- Policy Making: Guiding government policies aimed at improving living standards and economic growth.

And, let’s not forget its impact on international trade . PPP helps to predict long-term exchange rates and can influence trade policies.

Challenges and Criticisms of PPP

Now, let’s be honest, PPP isn’t perfect. It’s a theoretical concept, and there are several challenges in applying it in the real world. One major issue is that it assumes that goods and services are easily traded between countries.

But in reality, there are trade barriers, transportation costs, and other factors that can prevent prices from equalizing. Plus, some goods and services are simply not tradable – like haircuts or local transportation.

Another criticism is that PPP calculations can be sensitive to the choice of the basket of goods and services used. Different baskets can lead to different PPP rates.

Despite these limitations, PPP remains a valuable tool for understanding global economic dynamics. According to a research paper published in the Journal of International Economics, even with its imperfections, PPP provides a better measure of relative economic performance than nominal exchange rates.

The Future of PPP and India’s Economic Trajectory

So, what does the future hold for PPP and India? As India continues to develop and integrate into the global economy, understanding PPP will become even more crucial. As India’s economy grows, its purchasing power will also increase, further solidifying its position as a major global player.

And, with ongoing efforts to reduce trade barriers and improve infrastructure, the gap between India’s nominal GDP and its PPP-adjusted GDP is likely to narrow over time.

What fascinates me is how PPP can be used to track India’s progress towards becoming a developed nation. By monitoring changes in India’s PPP-adjusted GDP, we can get a sense of how quickly living standards are improving and how India is catching up with the rest of the world.

It’s not just about numbers; it’s about people’s lives and their ability to afford a better quality of life. This understanding is critical for policymakers, investors, and anyone interested in India’s economic future.

FAQ | Your PPP Questions Answered

What if I don’t understand economics? Is PPP still relevant to me?

Absolutely! Even if you’re not an economist, understanding the basic concept of PPP can help you make better decisions about your finances, especially if you’re planning to travel or invest abroad.

How is PPP different from the exchange rate?

The exchange rate is the price of one currency in terms of another. PPP, on the other hand, is a measure of the relative purchasing power of different currencies. Exchange rates can fluctuate wildly, while PPP is a more stable measure of relative economic strength.

Can PPP predict future exchange rates?

While PPP is often used as a long-term predictor of exchange rates, it’s not always accurate in the short term. Many other factors can influence exchange rates, such as interest rates, political events, and market sentiment.

Where can I find reliable PPP data for different countries?

You can find PPP data from organizations like the World Bank, the International Monetary Fund (IMF), and the Organisation for Economic Co-operation and Development (OECD).

In conclusion , PPP isn’t just an economic concept; it’s a lens through which we can better understand the world around us. It allows us to make more informed decisions about investments, travel, and policy.

By understanding how India stacks up against other nations in terms of purchasing power, we can get a clearer picture of its economic strengths, challenges, and potential. And that, my friends, is something worth caring about.