Why is Your Income Tax Refund Delay Happening? Decoding the Delays and What You Can Do

Okay, let’s be real. Waiting for your income tax refund feels a bit like waiting for Halley’s Comet – you know it’s coming, but the anticipation can be agonizing. If you’re sitting there, tapping your foot, wondering where your hard-earned money is, you’re not alone. I get it. I initially thought that filing taxes was the end of the road, but now the real wait begins. This isn’t just about the money (though that’s a big part of it!). It’s about understanding why these delays happen and, more importantly, what you can actually do about it. Here’s the thing: it impacts many of us across India.

Thank you for reading this post, don't forget to subscribe!Understanding the Reasons Behind Income Tax Refund Delays

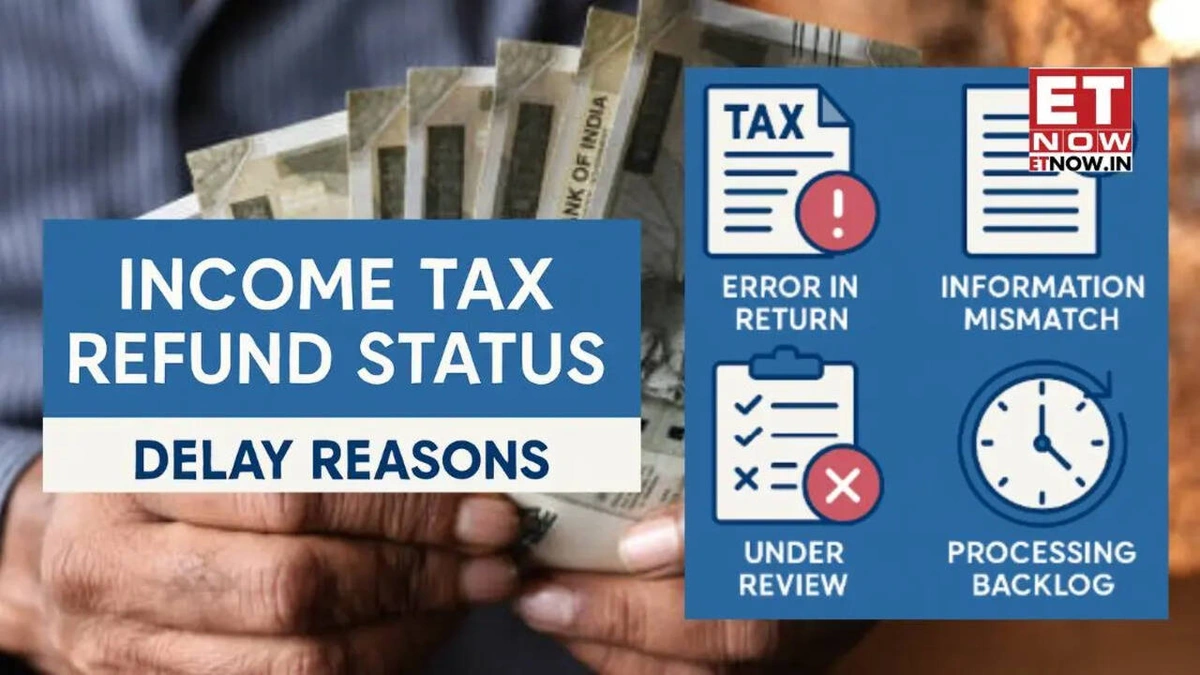

So, what’s the hold-up? Let’s break down the usual suspects. The Income Tax Department, while generally efficient, deals with a massive volume of returns. I mean, think about the sheer number of people filing taxes across India – it’s mind-boggling. A common mistake I see people make is assuming that once they’ve clicked ‘submit,’ the money magically appears in their account. Not quite! There are several layers of processing involved. Let me rephrase that for clarity.

Firstly, there’s the initial verification process. Your return goes through a series of automated checks to ensure everything matches up – your PAN details, the TDS certificates submitted by your employer, and the information you’ve declared. Any discrepancies here can trigger a delay. For example, a mismatch in your bank account details can throw a wrench in the works. The Income Tax Department might need to manually verify certain aspects of your return, which can add to the processing time. According to the official website, returns with discrepancies are flagged for further review. Also, sometimes it’s just the sheer volume of returns being processed that causes the backlog. You can always check your ITR refund status on the income tax portal .

Common Errors That Trigger Delays (And How to Avoid Them)

What fascinates me is how often simple errors cause major headaches. A common one is incorrect bank details. Double-check (and triple-check!) that your account number, IFSC code, and name are exactly as they appear on your bank statement. Even a small typo can send your refund into limbo. Another frequent culprit is failing to verify your ITR. Remember, just filing isn’t enough. You need to verify it either online (through Aadhaar OTP, net banking, or EVC) or by sending a physical copy to CPC Bangalore. This verification confirms that you indeed filed the return, and it needs to be done within 30 days of filing. I initially thought this was straightforward, but then I realized that it’s one of the most common reasons for delays. The one thing you absolutely must double-check on your ITR is if your PAN is linked to your Aadhaar. Here’s why it matters: the Central Board of Direct Taxes (CBDT) has made it mandatory, and failure to do so can lead to processing delays or even rejection of your return.

How to Check Your ITR Refund Status and Escalate Issues

Okay, so you’ve filed your return, verified it, and patiently waited. But weeks (or even months) have passed, and still no refund. What do you do? Don’t panic! You can easily check your ITR refund status online. Head over to the e-filing portal of the Income Tax Department. You’ll need your PAN, assessment year, and mobile number. The portal will show you the current status of your refund – whether it’s processed, under process, or failed. The key steps involved include: logging into the e-filing portal, navigating to the ‘e-File’ section, selecting ‘Income Tax Returns’, and then clicking on ‘View Filed Returns’.

If the status shows ‘under process’ for an extended period, it might be time to escalate the issue. You can raise a grievance on the e-filing portal. Provide all the necessary details – your PAN, assessment year, acknowledgement number, and a clear description of the issue. The Income Tax Department usually responds within a reasonable timeframe. But, if you don’t get a satisfactory response, you can also contact the Income Tax Ombudsman. According to the latest circular on the official Income Tax Department website, it’s crucial to have all your documents handy when raising a grievance. You might need to provide proof of filing, verification, and any other relevant information. Sometimes, a little nudge is all it takes to get things moving.

The Impact of Assessment Year and Filing Date

The assessment year (AY) plays a crucial role in determining when you should expect your refund. The assessment year is the year following the financial year for which you are filing taxes. So, for income earned between April 1, 2023, and March 31, 2024 (financial year 2023-24), the assessment year is 2024-25. Generally, the Income Tax Department aims to process refunds within a few months of filing. However, this timeline can vary depending on the assessment year and the volume of returns filed. Early filers often receive their refunds sooner, as their returns are processed before the rush. However, as per the guidelines mentioned in the information bulletin, delays can occur during peak filing seasons due to the sheer volume of returns.

What fascinates me is that the filing date also influences the processing time. Those who file their returns closer to the deadline might experience longer delays, as the department is swamped with returns at that time. Here’s the thing: It is generally a good idea to try to file your taxes as soon as possible. But, and this is a big but, make sure you have all the necessary documents and information before you file. Filing a rushed return with errors is worse than filing a slightly delayed but accurate one. As per the latest data, the average processing time for returns filed early in the assessment year is significantly lower than those filed closer to the deadline. Also, if you have any unpaid taxes from previous years, the Income Tax Department might adjust your refund to cover those dues. This can also lead to a partial refund or no refund at all.

Understanding Partial Refund and Adjustments

Sometimes, you might receive a partial refund instead of the full amount you were expecting. This usually happens when the Income Tax Department adjusts your refund to account for outstanding tax dues from previous years. They might also adjust your refund if they find any discrepancies in your return that result in a lower refund amount. But let’s be honest here, figuring this out can be a headache. Let me rephrase that for clarity. The Income Tax Department will usually send you a notice explaining the reasons for the adjustment. Make sure you read this notice carefully to understand why your refund was reduced. If you disagree with the adjustment, you can file a rectification request on the e-filing portal. Provide all the supporting documents to justify your claim. The Income Tax Department will review your request and make a decision.

Here’s the thing: Understanding the reasons for the partial refund and taking appropriate action is crucial. Ignoring the notice or failing to respond can lead to further complications. You can also seek professional help from a tax advisor if you find the process confusing. According to tax experts, it’s always better to address these issues promptly to avoid any potential penalties or interest charges. What fascinates me is how many people simply ignore these notices, hoping the problem will go away. But, and this is a big but, ignoring the problem rarely makes it disappear. It usually just makes it worse.

FAQ: Navigating Income Tax Refund Delays

What if I forgot my transaction id and cannot check my refund status?

You can still check your status using your PAN, assessment year, and mobile number on the e-filing portal.

How long does it typically take to receive an income tax refund?

The Income Tax Department usually processes refunds within a few weeks to months after filing and verification.

What if my bank account details are incorrect in my income tax return?

You’ll need to submit a rectification request on the e-filing portal to update your bank account details.

Can I claim interest on delayed income tax refund?

Yes, if the delay is due to the department’s fault, you are entitled to interest on the refund amount.

What if I receive a notice from the Income Tax Department regarding my refund?

Read the notice carefully and respond promptly, providing all the necessary information and documents.

So, there you have it. Decoding the mystery of the delayed income tax refund . It’s not always a smooth ride, but with a little understanding and proactive action, you can navigate the process and get your hard-earned money back where it belongs. The Income Tax Department might adjust your refund to cover those dues. This can also lead to a partial refund or no refund at all. And remember, patience is a virtue (especially when dealing with taxes!), but don’t hesitate to take action if you feel things are taking too long. It is always prudent to understand bank holidays before planning for any financial matter.