HDFC ELSS Tax Saver :Save Tax & Grow Wealth Smartly 2025.

HDFC ELSS Tax Saver In the intricate world of personal finance, the dual pursuit of tax optimization and long-term wealth creation often leads investors down complex paths. For discerning investors in 2025, navigating the landscape of financial instruments requires a blend of savvy planning and strategic foresight. Amidst a plethora of options, Equity Linked Savings Schemes (ELSS) stand out as a uniquely powerful tool, offering a potent combination of tax deductions and the growth potential of equity markets. At the forefront of this category is a seasoned performer: the HDFC ELSS Tax Saver Fund.

Thank you for reading this post, don't forget to subscribe!Launched in the nascent stages of the Indian mutual fund industry, this fund has not only weathered numerous market cycles but has also established itself as a reliable vehicle for investors aiming to achieve their financial goals. This comprehensive analysis delves into the HDFC ELSS Tax Saver Fund, exploring its mechanics, performance, and strategic positioning as an intelligent choice for saving tax and growing wealth in 2025.

The ELSS Advantage: More Than Just Tax Savings

Before zooming in on the specifics of the HDFC fund, it’s crucial to understand the compelling proposition of ELSS as a category. These are diversified equity mutual funds that come with a distinct tax-saving advantage under Section 80C of the Income Tax Act, 1961.

1. The Power of Tax Deduction: The primary allure for many investors is the significant tax benefit. Investments made in ELSS funds are eligible for a deduction of up to ₹1.5 lakh from your gross total income in a financial year.For an individual in the highest tax bracket (30%), this translates into a direct tax saving of up to ₹46,800 annually.

2. The Shortest Lock-in Period: A key differentiator for ELSS is its mandatory three-year lock-in period, the shortest among all tax-saving instruments under Section 80C.This is considerably more liquid than the Public Provident Fund (PPF), which has a 15-year maturity, or tax-saving Fixed Deposits (FDs) that require a 5-year lock-in.This shorter time frame not only offers better accessibility to funds post-lock-in but also instills a disciplined long-term investment habit.

3. The Engine of Wealth Creation: Unlike traditional fixed-income tax-saving options that offer modest, predetermined returns, ELSS funds are intrinsically linked to the equity market.By investing a minimum of 80% of their assets in stocks, these funds possess the potential to generate significantly higher returns over the long term, comfortably beating inflation and facilitating substantial wealth accumulation.

4. Taxation of Gains: Post the three-year lock-in, any gains from ELSS investments are classified as Long-Term Capital Gains (LTCG). These gains are taxed at a concessional rate of 10% on amounts exceeding ₹1 lakh in a financial year, making it a tax-efficient avenue for wealth creation.

Spotlight on HDFC ELSS Tax Saver Fund: A Legacy of Performance

Having been in existence since March 1996, the HDFC ELSS Tax Saver Fund is one of the oldest and most respected names in its category.This long history provides a rich tapestry of performance data across various economic conditions. Managed by HDFC Mutual Fund, one of India’s premier asset management companies, the fund commands significant investor trust, reflected in its substantial Assets Under Management (AUM) of approximately ₹16,579 crore as of mid-2025.The fund is currently helmed by experienced fund managers Dhruv Muchhal and Roshi Jain.

The fund’s primary investment objective is to generate long-term capital appreciation from a diversified portfolio composed predominantly of equity and equity-related instruments, benchmarked against the NIFTY 500 Total Return Index.

Investment Strategy: A Balanced Approach to Growth

The HDFC ELSS Tax Saver Fund is distinguished by its growth-oriented investment style, underpinned by a meticulous bottom-up approach to stock selection. The fund management team focuses on identifying fundamentally robust companies with strong management teams, a proven track record of corporate governance, and clear growth drivers for the medium to long term.

Portfolio Composition and Market Cap Allocation:

A defining feature of the fund’s strategy in 2025 is its distinct large-cap bias. The portfolio typically allocates between 73% and 79% of its assets to large-cap stocks.This significant exposure to well-established, blue-chip companies provides a layer of stability and acts as a cushion during volatile market phases.The remainder of the portfolio is prudently allocated to select mid-cap (around 4%) and small-cap (around 11%) stocks, which inject growth potential and the opportunity for higher returns.This balanced structure makes it a relatively conservative option within the ELSS category, appealing to investors who seek steady growth without exceptionally high volatility.

Sectoral Diversification and Top Holdings:

The fund maintains a well-diversified portfolio across various sectors to mitigate concentration risk. As of 2025, a significant portion of its investments are in the Financial, Automobile, Healthcare, Technology, and Insurance sectors. A look at its top holdings offers a transparent view into its high-conviction bets on India’s leading companies. The portfolio is anchored by names such as HDFC Bank, ICICI Bank, Axis Bank, Cipla, and SBI Life Insurance Company.

Furthermore, the fund is known for its relatively low portfolio turnover ratio, which signifies a buy-and-hold strategy. This reflects the management’s high conviction in its stock selections and its commitment to long-term value investing, which also helps in keeping transactional costs down.

Performance Analysis: A Consistent Wealth Creator

The ultimate test for any investment is its performance and the HDFC ELSS Tax Saver Fund has a compelling story to tell. It has consistently delivered strong returns, often outperforming both its benchmark and the category average over various time horizons.

As of 2025, the fund’s trailing returns showcase its robust growth trajectory. Investors have enjoyed impressive annualized returns, with the 3-year Compounded Annual Growth Rate (CAGR) hovering around 21-22% and the 5-year CAGR reaching an exceptional 24-25%.

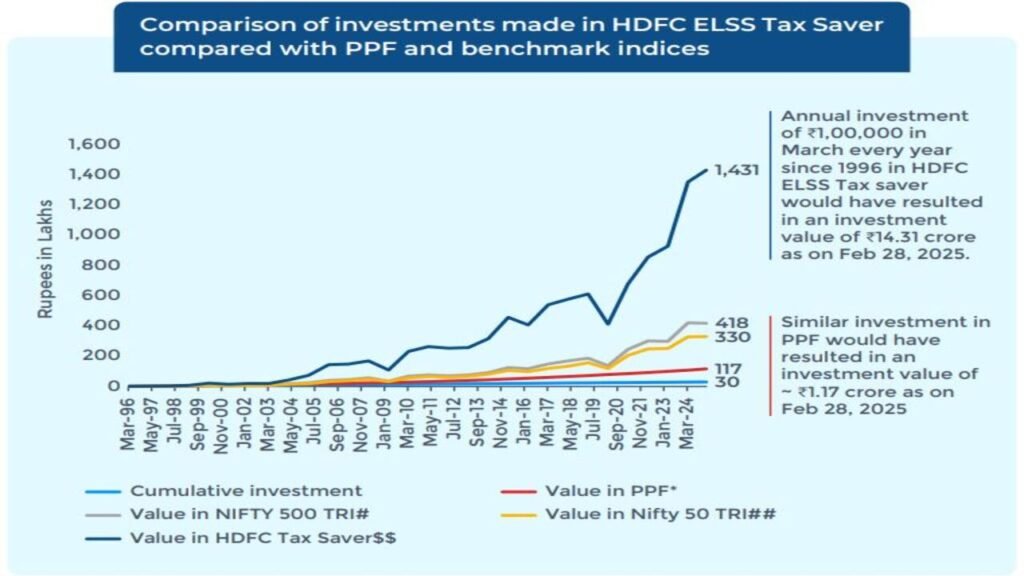

To put this into perspective, a lump-sum investment of ₹1 lakh made five years ago would have grown to approximately ₹2.98 lakh today. An even more powerful illustration is the result of disciplined, long-term investing: a Systematic Investment Plan (SIP) of ₹1,00,000 invested annually since the fund’s inception in 1996 would have burgeoned into a colossal corpus of ₹15.2 crore by March 2025. This stands in stark contrast to a similar investment in the traditional PPF, which would have grown to about ₹1.17 crore over the same period.

Beyond absolute returns, the fund has demonstrated a commendable ability to manage risk. Its standard deviation, a measure of volatility, is lower than many of its peers, indicating a less bumpy ride for investors. It has shown a high capacity to control losses during market downturns while effectively capturing upside potential, making it a suitable choice for investors who prioritize stability alongside growth.

Why Choose HDFC ELSS Tax Saver Fund in 2025?

For an investor finalizing their tax-saving investments for the year, here are the key reasons why the HDFC ELSS Tax Saver Fund merits serious consideration:

- Venerable Track Record: Having successfully navigated the Indian equity markets for nearly three decades, the fund has a proven ability to perform across different economic cycles.

- Reputable Fund House: It is backed by the robust research capabilities and institutional integrity of HDFC Mutual Fund.

- Stability-Oriented Portfolio: The pronounced large-cap allocation offers a degree of resilience against market downturns, making it a suitable core holding for moderate-risk investors.

- Consistent Outperformance: The fund has a demonstrable history of outperforming its benchmark and peer group, indicating skilled fund management.

- The Unbeatable Dual Advantage: It seamlessly combines the immediate gratification of tax savings with the long-term reward of wealth creation through equities.

- Democratized Access: With a minimum investment amount of just ₹500 for both lump-sum and SIP investments, it is accessible to every investor, regardless of their budget.

How to Invest: SIPs and Lumpsum

Investing in the HDFC ELSS Tax Saver Fund is straightforward and can be done through two primary methods:

- Lump-Sum Investment: This involves investing a single, substantial amount at one time. It’s suitable for investors who have a ready corpus available.

- Systematic Investment Plan (SIP): This allows investors to invest a fixed amount at regular intervals (typically monthly).SIPs are highly recommended as they promote disciplined investing and help in averaging the cost of purchase over time, a phenomenon known as rupee cost averaging. This mitigates the risk of entering the market at a peak.

Investors can choose between a Direct Plan, which is bought directly from the fund house and has a lower expense ratio (around 1.09%), and a Regular Plan, which is bought through an intermediary and has a slightly higher expense ratio (around 1.7%) to account for commissions. Investments can be made through various channels, including the HDFC Mutual Fund website and app, RTA websites, stock exchange platforms, and financial advisors.

Ideal Investor Profile

The HDFC ELSS Tax Saver Fund is particularly well-suited for:

- Salaried individuals and other taxpayers looking to fully utilize the ₹1.5 lakh deduction under Section 80C.

- Investors with a long-term horizon of at least 3 to 5 years who are seeking capital appreciation.

- Beginners in the equity market who want to dip their toes into stock investing through a professionally managed, tax-efficient product.

- Investors who appreciate a growth strategy that is balanced with a degree of stability, thanks to the fund’s large-cap focus.

Understanding the Risks

As an equity-oriented scheme, the HDFC ELSS Tax Saver Fund is subject to market risks, and returns are not guaranteed.The fund’s Net Asset Value (NAV) will fluctuate in line with the performance of its underlying stocks. It is categorized under the “Very High” risk level. The mandatory three-year lock-in period also means that the invested capital is illiquid during this time and cannot be withdrawn, even in an emergency.

The Final Verdict

In the financial landscape of 2025, the HDFC ELSS Tax Saver Fund continues to stand tall as a testament to the power of disciplined, long-term investing. It offers an elegant and effective solution to the twin challenges of tax planning and wealth creation. Its long-standing legacy, consistent performance, experienced management, and a well-balanced investment strategy make it a formidable contender in the tax-saving space.

For investors who understand the inherent risks of equity and have the patience to remain invested, this fund offers a clear pathway to not only reduce their tax liability today but also build a substantial corpus for their future financial aspirations. In a world of fleeting financial trends, the enduring philosophy of the HDFC ELSS Tax Saver Fund—to save tax smartly while participating in India’s growth story—remains as relevant and potent as ever.