Understanding GST on Cars in India | A Complete Guide

Buying a car in India? Let’s be honest, it’s a big decision, and understanding the GST on cars is a crucial part of the process. It’s not just about the showroom price; it’s about the total cost you’ll be paying, and GST plays a significant role. But what exactly is GST, how does it affect car prices, and are there any ways to navigate it? I’ve been there, done that, and I’m here to break it down for you in a way that’s easy to understand.

Thank you for reading this post, don't forget to subscribe!GST Rates on Cars | Decoding the Numbers

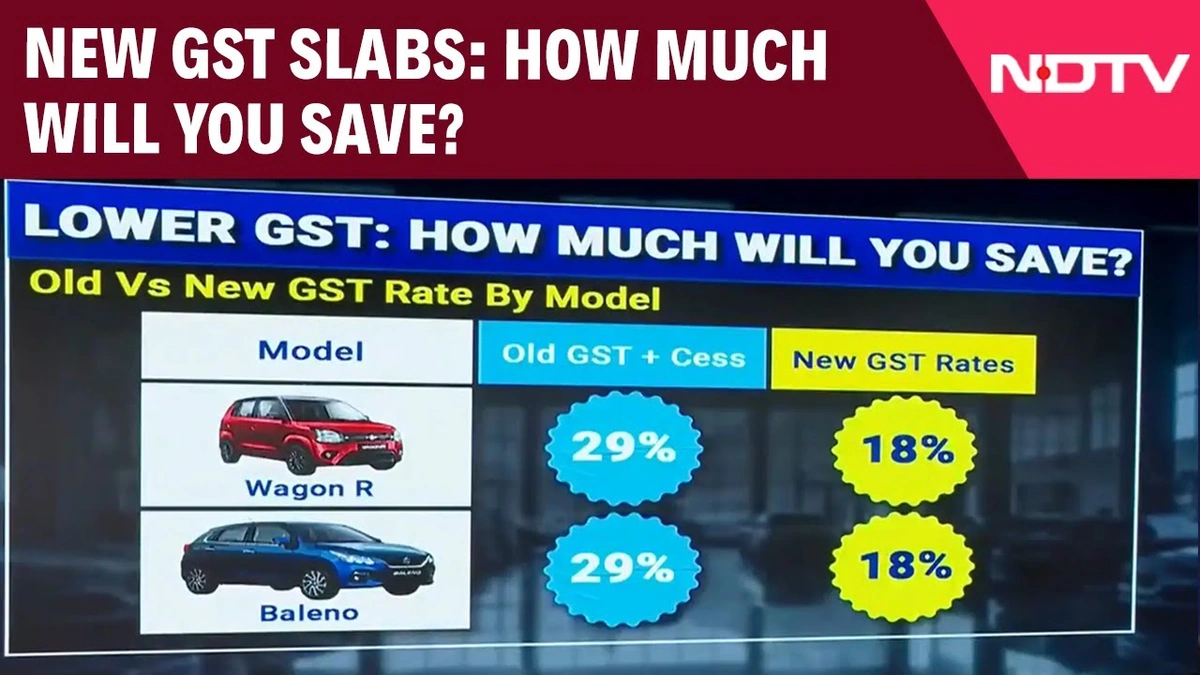

So, you’re probably wondering, “What’s the GST rate on my dream car?” Here’s the thing: it’s not a one-size-fits-all situation. The GST rate on cars in India depends on a few factors, primarily the type of car and its engine capacity. Generally, cars attract a 28% GST. But, there’s a catch: an additional cess is levied on top of this 28%. This cess varies depending on the vehicle’s category. For smaller cars, the cess is lower compared to luxury vehicles and SUVs. According to the CBIC , the exact cess percentage can fluctuate, so it’s vital to stay updated. For example, small petrol cars usually attract lower total GST than large diesel SUVs due to the cess component. The government uses these rates to encourage fuel efficiency and discourage pollution.

How GST Impacts Car Prices | A Practical Example

Let’s take a scenario: You’re eyeing a hatchback priced at ₹6,00,000 before taxes. Now comes the GST. At a 28% GST rate, that adds ₹1,68,000. But remember the cess? Let’s say it’s 1% for this particular car. That’s another ₹6,000. So, the final GST amount is ₹1,74,000, bringing the on-road price to ₹7,74,000. See how quickly it adds up? This calculation is crucial when comparing different models. Always ask for the ‘on-road price’ to get the complete picture, including GST and other charges like registration and insurance. Don’t just focus on the ex-showroom price; that’s only half the story. And remember, this example is simplified; actual calculations can be more complex depending on the car’s specifications and state-specific taxes.

Understanding the Composition Scheme and its benefits

The GST composition scheme is designed to offer a simplified tax regime for small businesses. But how does it apply to the automotive industry, especially dealerships? Well, the composition scheme isn’t generally applicable to car dealerships themselves because they typically exceed the turnover threshold for eligibility. However, ancillary businesses related to the automotive sector, such as small spare parts retailers or car detailing services with a turnover below the specified limit, can opt for the composition scheme. The primary advantage? Reduced compliance burden. Instead of filing monthly returns, businesses under the composition scheme file quarterly returns and pay a fixed percentage of their turnover as tax. However, they can’t claim input tax credit (ITC). This scheme simplifies taxation for small players, allowing them to focus more on their core operations. It’s a trade-off – lower compliance versus no ITC benefits. Always consult with a tax professional to see if the composition scheme is right for your business. Check other investment options.

GST on Electric Vehicles (EVs) | A Different Ballgame

Now, let’s talk about electric vehicles. The government is actively promoting EVs, and the GST rates reflect this. As of now, EVs attract a lower GST rate of 5%. This is significantly lower than the 28% (plus cess) for conventional cars. Why this difference? It’s a strategic move to encourage adoption of eco-friendly vehicles. The lower GST on electric vehicles makes them more affordable, incentivizing buyers to switch from petrol or diesel cars. This initiative aligns with India’s commitment to reduce carbon emissions and promote sustainable transportation. So, if you’re considering buying a car and are environmentally conscious, EVs are definitely worth a look, not just for their green credentials but also for the GST benefits. Also, you can read about new GST rates on cars.

Tips for Navigating GST on Your Car Purchase

Okay, so you’re armed with the knowledge. But how do you use it to your advantage? Here are a few practical tips:

- Negotiate the on-road price: Don’t just focus on the ex-showroom price. Get a clear breakdown of all the charges, including GST, registration, and insurance.

- Compare different models: Use online GST calculator tools to compare the final prices of different cars after GST.

- Stay updated on GST rates: GST rates and cess percentages can change. Keep an eye on government notifications for any revisions.

- Consider EVs: If you’re open to electric vehicles, remember the lower GST rate can make them a more attractive option.

- Seek professional advice: If you’re unsure about any aspect of GST, consult with a tax advisor or financial planner.

Frequently Asked Questions (FAQ)

What if I forgot my application number?

Contact the helpdesk immediately for assistance. They can guide you through the process of retrieving your application number.

Can I claim the Input Tax Credit (ITC) on GST paid for my car?

Generally, individuals cannot claim ITC on GST paid for personal vehicles. However, businesses can claim ITC on cars used for business purposes, subject to certain conditions.

How often do GST rates on cars change?

GST rates are subject to change based on government decisions and economic factors. Keep track of the latest notifications and press releases from the Ministry of Finance.

Are there any state-specific taxes on cars in addition to GST?

Yes, state governments levy road tax and registration charges, which are separate from GST. These vary from state to state.

Does GST apply to used cars as well?

Yes, GST applies to the sale of used cars, but at a lower rate than new cars.

Understanding GST implications on cars might seem daunting at first, but with a little research and planning, it becomes manageable. Remember, knowledge is power, especially when it comes to making a significant purchase like a car. So, arm yourself with information, ask the right questions, and drive away with confidence!