Cash Balance Retirement Plan Guide Save for Future.

Cash Balance Retirement Plan is a powerful tool for building a secure financial future, particularly for high-income professionals, small business owners, and self-employed individuals. Combining the benefits of defined benefit plans with the flexibility of defined contribution plans, CBRPs offer significant tax advantages, high contribution limits, and a predictable retirement benefit. As of August 31, 2025, with economic uncertainties like fluctuating interest rates and evolving tax policies, CBRPs are gaining popularity as a retirement savings strategy. This comprehensive guide explores how Cash Balance Retirement Plans work, their benefits, eligibility, setup process, and strategies to maximize savings. A detailed table summarizes key aspects to help you plan effectively for your future.

Thank you for reading this post, don't forget to subscribe!What is a Cash Balance Retirement Plan?

A Cash Balance Retirement Plan is a type of defined benefit pension plan that operates like a hybrid between a traditional pension and a 401(k). In a CBRP, each participant has a hypothetical account that grows through two components:

- Pay Credit: An annual contribution from the employer, typically a percentage of salary or a fixed dollar amount.

- Interest Credit: A guaranteed annual interest rate (often 4-5%) or a rate tied to a benchmark, like the 30-year Treasury yield.

Unlike traditional pensions, which promise a fixed monthly payment in retirement, CBRPs express benefits as a lump-sum account balance, which can be rolled over into an IRA or taken as an annuity upon retirement. The employer bears the investment risk, ensuring the account grows predictably regardless of market performance.

In 2025, Cash Balance Retirement Plan are especially appealing due to their high contribution limits—often exceeding $100,000 annually for older participants—compared to 401(k) limits ($24,500, plus $8,000 catch-up for those 50+). They are ideal for high earners aiming to accelerate retirement savings while reducing taxable income.

Why Consider a Cash Balance Retirement Plan?

Cash Balance Retirement Plan offer unique advantages for retirement planning:

- High Contribution Limits: Allow substantial annual contributions, far exceeding those of 401(k)s or IRAs.

- Tax Advantages: Contributions are tax-deductible for the employer, reducing taxable income, while earnings grow tax-deferred for participants.

- Predictable Benefits: Guaranteed interest credits provide stability, unlike market-dependent 401(k) plans.

- Flexibility: Benefits can be taken as a lump sum or annuity, offering options at retirement.

- Employee Recruitment Tool: Small businesses can attract talent by offering robust retirement benefits.

According to the Pension Benefit Guaranty Corporation, over 19 million Americans were covered by defined benefit plans in 2023, with Cash Balance Retirement Plan growing due to their flexibility. However, they require careful management due to high setup and maintenance costs.

How Cash Balance Plans Work

Structure

- Hypothetical Account: Each participant has an account showing their pay and interest credits, similar to a 401(k) statement.

- Employer Responsibility: The employer funds the plan and assumes investment risk, ensuring the promised benefit is met.

- Funding Formula: Contributions are based on a formula (e.g., 5% of salary plus 4% interest) set by the plan’s actuary, compliant with IRS regulations.

Funding and Investments

Employers contribute annually to a pooled trust, managed by a professional to meet the plan’s obligations. Investments may include bonds, stocks, or other assets, but participants receive guaranteed interest credits regardless of market performance. In 2025, plans often use conservative portfolios to align with low-risk interest credits (e.g., 4% fixed or tied to Treasury yields).

Payout Options

At retirement, participants can:

- Roll the balance into an IRA for continued tax-deferred growth.

- Convert the balance into an annuity for guaranteed monthly payments.

- Take a lump-sum distribution, subject to taxes and potential penalties if under 59½.

IRS Limits

The IRS sets annual benefit limits based on age and income. In 2025, the maximum annual benefit at retirement age (typically 62) is approximately $275,000, translating to lump sums of $2.5-$3 million for older participants, depending on actuarial calculations.

Who Should Use a Cash Balance Plan?

Cash Balance Retirement Plan are best suited for:

- High-Income Professionals: Doctors, lawyers, or consultants earning over $250,000 annually, seeking to save more than 401(k)/IRA limits allow.

- Small Business Owners: Those with steady cash flow who want tax deductions and employee benefits.

- Older Workers: Individuals 45+ can contribute more due to shorter time horizons, maximizing tax-deferred savings.

- Partners in Firms: Law or medical practices often use CBRPs to equalize benefits among partners of different ages.

Employees of businesses offering Cash Balance Retirement Plan also benefit, as contributions are employer-funded, supplementing other retirement plans like 401(k)s.

Benefits of Cash Balance Plans

- Tax Savings: Employer contributions reduce taxable income significantly. For example, a $100,000 contribution for a business owner in the 37% tax bracket saves $37,000 in taxes.

- High Savings Potential: Older participants can contribute $100,000-$150,000 annually, compared to $32,500 for a 401(k) with catch-up.

- Creditor Protection: CBRP assets are generally protected from creditors under federal law, unlike some other accounts.

- Customizable Design: Plans can be tailored to favor owners or key employees while meeting IRS nondiscrimination rules.

- Employee Retention: Offering a CBRP enhances a company’s benefits package, attracting and retaining talent.

Risks and Challenges

- High Costs: Setup fees ($2,000-$5,000) and annual administration costs ($3,000-$10,000) require significant cash flow.

- Funding Obligations: Employers must contribute annually, even in low-profit years, to meet IRS requirements.

- Complexity: Actuarial calculations and IRS compliance demand professional management, increasing costs.

- Market Risk for Employers: If investments underperform, employers must cover shortfalls to meet guaranteed benefits.

- Limited Portability: Employees leaving before vesting (typically 3-6 years) may lose some benefits.

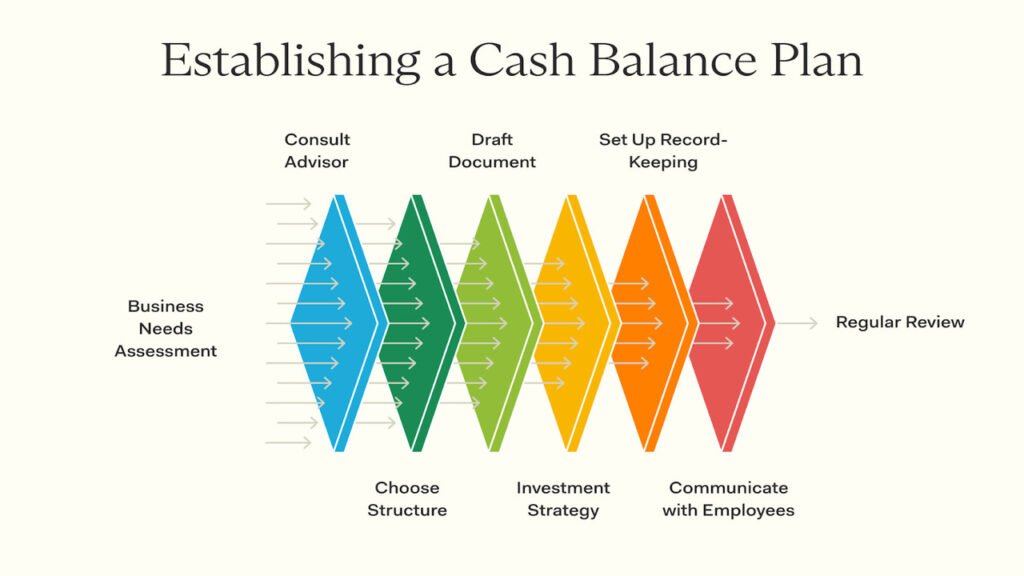

How to Set Up a Cash Balance Plan in 2025

- Consult a Professional: Hire an actuary or third-party administrator (TPA) specializing in defined benefit plans to design the plan and ensure IRS compliance.

- Define the Formula: Choose pay and interest credit formulas (e.g., 5% of salary + 4% interest) based on your goals and budget.

- Meet IRS Requirements: Ensure the plan passes nondiscrimination tests, providing equitable benefits to employees.

- Fund the Plan: Make initial and annual contributions to the trust, managed by a financial advisor or investment manager.

- Communicate to Employees: Educate staff about the plan’s benefits, especially if used as a recruitment tool.

- File with the IRS: Submit Form 5500 annually and comply with ERISA regulations.

2025 Economic Context

As of August 31, 2025, key factors influence CBRP adoption:

- Interest Rates: Stable rates (IRS Q4 2025 rates unchanged) make fixed interest credits (4-5%) predictable, encouraging conservative plan designs.

- Tax Policies: Potential tax code changes may affect deductions, so consult a tax advisor for 2025-specific rules.

- Inflation: Rising costs emphasize the need for substantial retirement savings, making high-limit CBRPs attractive.

- Market Volatility: Conservative investment strategies in Cash Balance Retirement Plan provide stability amid stock market fluctuations.

Strategies to Maximize Your Cash Balance Plan

- Pair with a 401(k): Combine a CBRP with a 401(k) to maximize contributions (e.g., $150,000 CBRP + $32,500 401(k) for a 50-year-old).

- Optimize Tax Deductions: Time contributions to offset high-income years, reducing tax liability.

- Plan for Vesting: Structure vesting schedules to retain key employees while meeting IRS rules.

- Monitor Funding: Work with an actuary to adjust contributions if investment returns deviate, avoiding underfunding penalties.

- Review Annually: Adjust the plan for changes in income, employee count, or tax laws.

Table: Cash Balance Retirement Plan Overview (2025)

| Aspect | Details | Benefits | Challenges | 2025 Considerations |

|---|---|---|---|---|

| Contribution Limits | Up to $275,000 annual benefit; lump sums $2.5-$3M | High savings for high earners | Requires steady cash flow | Higher limits for ages 50+ |

| Tax Advantages | Employer contributions tax-deductible; tax-deferred growth | Saves 30-37% on taxes for high earners | Complex IRS compliance | Monitor 2025 tax code changes |

| Interest Credits | 4-5% fixed or tied to Treasury yields | Predictable growth | Employer bears shortfall risk | Stable rates favor fixed credits |

| Setup Costs | $2,000-$5,000 initial; $3,000-$10,000 annually | Customizable for owners | High administrative costs | Budget for actuary/TPA fees |

| Payout Options | Lump sum, IRA rollover, or annuity | Flexible retirement planning | Taxes/penalties if taken early | Rollovers to IRAs for tax deferral |

Case Study: Dr. Patel’s Retirement Strategy

Dr. Patel, a 50-year-old physician earning $400,000 annually, owns a practice with 5 employees. In 2025, she sets up a CBRP:

- Contribution: $120,000 for herself, $20,000 per employee.

- Tax Savings: $44,400 (37% bracket) from her contribution alone.

- Plan Design: 5% pay credit + 4% interest credit, fully vesting after 3 years.

- Outcome: After 10 years, her account grows to $1.8M, which she rolls into an IRA at retirement, supplementing her 401(k).

Dr. Patel’s practice benefits from tax deductions and improved employee retention, demonstrating the plan’s dual advantages.

Common Misconceptions

- “CBRPs are only for large companies.” They’re ideal for small businesses or solo practitioners with high incomes.

- “They’re too risky for employers.” Proper actuarial management minimizes funding risks.

- “Employees get no benefits.” IRS rules ensure equitable contributions for all participants.

Community Insights

The r/personalfinance subreddit praises Cash Balance Retirement Plan for high earners, with posts noting their ability to save $100,000+ annually. Users caution about high costs and recommend pairing with 401(k)s for maximum impact. In 2025, discussions highlight stable interest rates as a reason to adopt CBRPs now.

Frequently Asked Questions

1. What is a Cash Balance Retirement Plan (CBRP)?

A CBRP is a defined benefit pension plan with a hypothetical account for each participant, combining annual employer contributions (pay credits) and guaranteed interest credits (4-5%). It offers a predictable lump-sum or annuity at retirement, with higher contribution limits than 401(k)s or IRAs.

2. Who is eligible for a Cash Balance Plan?

Cash Balance Retirement Plan are ideal for high-income professionals, small business owners, and older workers (45+). They suit those earning over $250,000 or businesses with steady cash flow, offering tax deductions and substantial savings for owners and employees.

3. What are the tax benefits of a CBRP?

Employer contributions are tax-deductible, reducing taxable income (e.g., $37,000 saved on a $100,000 contribution in the 37% bracket). Earnings grow tax-deferred, and participants may roll over balances into IRAs to delay taxes further.

4. What are the risks of a Cash Balance Plan?

Risks include high setup ($2,000-$5,000) and annual administration costs ($3,000-$10,000), mandatory employer contributions, and investment risk borne by the employer. Underfunding or market underperformance requires additional contributions to meet guaranteed benefits.

5. How much can I contribute to a CBRP in 2025?

Contribution limits depend on age and income, with a maximum annual benefit of $275,000, equating to lump sums of $2.5-$3 million at retirement age (typically 62). Older participants can contribute $100,000-$150,000 annually, far exceeding 401(k) limits.