Artificial Intelligence in Banking :Trends & Impact.

Artificial Intelligence in Banking has emerged as a transformative force across industries, and banking is no exception. By simulating human intelligence through machine learning (ML), natural language processing (NLP), and advanced analytics, AI is revolutionizing how financial institutions operate, interact with customers, and manage risks. From enhancing customer experiences to streamlining operations and combating fraud, AI is reshaping the banking sector in profound ways. This article explores the applications, benefits, challenges, and future implications of AI in banking, emphasizing its role in driving efficiency, personalization, and security while addressing ethical and regulatory concerns.

Thank you for reading this post, don't forget to subscribe!Applications of Artificial Intelligence in Banking

AI’s versatility allows it to address multiple facets of banking, from customer-facing services to back-end operations. Below are some of the key applications transforming the industry.

1. Customer Service and Engagement

One of the most visible applications of AI in banking is in customer service. AI-powered chatbots and virtual assistants, equipped with NLP, provide 24/7 support, handling routine inquiries such as balance checks, transaction disputes, or loan applications. Artificial Intelligence in Banking These tools offer instant responses, reducing wait times and improving customer satisfaction. For instance, banks like HSBC and Bank of America use AI chatbots to resolve customer queries efficiently, freeing human agents to focus on complex tasks.

AI also enables hyper-personalized customer experiences. By analyzing vast amounts of data, including purchase histories and behavioral patterns, AI algorithms can recommend tailored financial products, such as credit cards or investment plans. This personalization enhances customer loyalty and increases cross-selling opportunities, as banks can anticipate client needs with precision.

2. Fraud Detection and Risk Management

Fraud detection is a critical area where AI excels. Machine learning algorithms analyze transaction patterns in real-time to identify anomalies indicative of fraudulent activity, such as unusual spending or unauthorized logins. Artificial Intelligence in Banking For example, a major U.S. bank uses a machine learning-based policy engine to block over 120,000 fraudulent calls per month, safeguarding its telephony systems. By detecting irregularities faster than human analysts, AI minimizes financial losses and enhances customer trust.

AI also plays a pivotal role in credit risk assessment. Traditional credit scoring models rely on static data, such as credit history, but AI incorporates dynamic data points, like social media activity or spending behavior, to create more accurate risk profiles. This enables banks to offer loans to underserved populations while maintaining risk control.

3. Automation of Operations

AI-driven automation streamlines repetitive and time-consuming tasks in banking. For instance, robotic process automation (RPA) powered by AI handles tasks like data entry, compliance checks, and document verification. This reduces operational costs and minimizes human error. Artificial Intelligence in Banking In currency counting, AI-enabled machines process transactions quickly and accurately, boosting efficiency in cash-heavy environments.

In loan processing, AI orchestrates complex workflows by analyzing applicant data, verifying documents, and assessing creditworthiness. Multi-agent systems, an emerging AI technology, can autonomously manage entire processes, such as loan approvals, by coordinating tasks across departments. These advancements reduce processing times from days to hours, improving both operational efficiency and customer experience.

4. Regulatory Compliance and Reporting

Compliance with regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements, is a significant challenge for banks. AI simplifies these processes by automating data collection and analysis. Artificial Intelligence in Banking Machine learning models can flag suspicious transactions for AML compliance, while NLP tools extract relevant information from unstructured documents for KYC verification. This not only ensures adherence to regulations but also reduces the time and cost associated with manual compliance checks.

5. Investment and Wealth Management

AI is transforming wealth management by powering robo-advisors that offer low-cost, algorithm-driven investment advice. Platforms like Betterment and Wealthfront use AI to create diversified portfolios based on a client’s risk tolerance and financial goals. Artificial Intelligence in Banking These systems continuously monitor market trends and adjust portfolios in real-time, making wealth management accessible to a broader audience.

Additionally, AI enhances trading strategies through predictive analytics. By analyzing historical market data and real-time economic indicators, AI models can forecast market trends, enabling banks to optimize investment decisions.

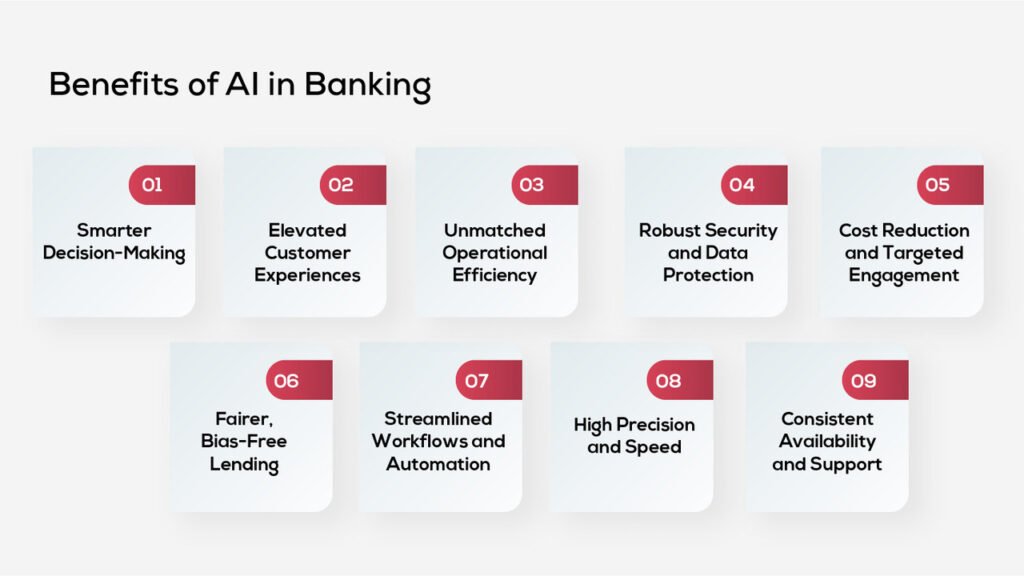

Benefits of AI in Banking

The integration of AI into banking offers numerous benefits that enhance efficiency, customer satisfaction, and profitability.

1. Enhanced Efficiency

AI automates repetitive tasks, allowing banks to process high volumes of transactions and inquiries with minimal human intervention. Artificial Intelligence in Banking This reduces operational costs and enables employees to focus on strategic initiatives. For example, AI-driven automation in currency counting and loan processing has increased daily business volumes while reducing errors.

2. Improved Customer Experience

AI’s ability to provide personalized services and instant responses significantly improves customer satisfaction. Chatbots ensure round-the-clock availability, while predictive analytics enable banks to offer tailored products, fostering stronger customer relationships.

3. Cost Reduction

By automating processes and improving fraud detection, AI reduces the financial burden of manual labor and losses from fraudulent activities. McKinsey estimates that AI can unlock significant productivity gains, potentially transforming entire banking workflows.

4. Better Decision-Making

AI’s data-driven insights enable banks to make informed decisions in areas like credit risk assessment, investment strategies, and customer segmentation. By leveraging real-time data, AI ensures decisions are both accurate and timely.

5. Increased Accessibility

AI democratizes financial services by enabling banks to serve underbanked populations. For instance, AI-based credit scoring models can assess the creditworthiness of individuals with limited credit histories, expanding access to loans and financial products.

Challenges of AI in Banking

Despite its transformative potential, AI adoption in banking faces several challenges that must be addressed to ensure responsible and effective implementation.

1. Data Privacy and Security

AI systems rely on vast amounts of customer data, raising concerns about privacy and security. Improper handling of personal information can lead to breaches, eroding customer trust. Banks must adhere to strict data protection regulations, such as GDPR, and adopt privacy-by-design principles to mitigate risks.

2. Job Displacement

AI-driven automation threatens jobs in sectors like customer service and data processing. A 2024 report suggests that 44% of workers’ skills will be disrupted by AI between 2023 and 2028, with women being particularly vulnerable. Banks must invest in reskilling programs to prepare employees for roles that complement AI technologies.

3. Bias in Algorithms

AI systems can inherit biases from the data they are trained on, leading to unfair outcomes. Artificial Intelligence in Banking For example, automated underwriting systems have been shown to recommend higher denial rates for minority groups. To address this, banks must prioritize human-centered AI (HCAI) approaches that ensure fairness and transparency.

4. Regulatory and Ethical Concerns

The rapid adoption of AI raises ethical questions about accountability and transparency. As AI systems become more autonomous, determining responsibility for errors becomes challenging. Banks must ensure that AI decisions are explainable and comply with ethical standards.

5. High Implementation Costs

Deploying AI requires significant investment in infrastructure, talent, and training. While AI promises long-term cost savings, the initial costs can be prohibitive for smaller banks, creating a digital divide in the industry.

The Future of AI in Banking

The future of AI in banking is promising, with emerging technologies like generative AI and multi-agent systems poised to further transform the industry. Artificial Intelligence in Banking Generative AI, which powers tools like ChatGPT, can create human-like interactions, enabling more sophisticated customer engagement. Multi-agent systems, which orchestrate complex workflows, could revolutionize processes like loan origination and fraud detection by autonomously coordinating tasks.

However, the path forward requires careful navigation. Banks must balance innovation with ethical considerations, ensuring AI systems are transparent, unbiased, and aligned with human values. Regulatory frameworks will play a crucial role in shaping AI’s development, with governments needing to establish guidelines that promote innovation while protecting consumers.

Investment in human capital is equally important. As AI reshapes job roles, banks must prioritize reskilling programs to create a workforce that complements AI technologies. For example, Axis Bank’s internal chatbot ‘Adi’ demonstrates how AI can empower employees by providing real-time support, highlighting the potential for human-AI collaboration.

Globally, AI’s impact on banking will vary. In regions like Asia, where consumer awareness and adoption of AI are high, banks are rapidly integrating AI into their operations. A study across five Asian countries found that factors like perceived usefulness and knowledge of AI positively influence adoption, though perceived risks remain a barrier. In contrast, smaller markets may face challenges due to limited resources, necessitating partnerships and government support to scale AI adoption.

Frequently Asked Questions

1. What is the role of AI in banking?

AI automates processes, enhances customer service, and improves fraud detection.

2. How does AI improve customer experience in banks?

Through chatbots, personalized services, and faster query resolution.

3. Can AI help prevent banking fraud?

Yes, AI detects suspicious transactions using real-time data analysis.

4. What are common AI applications in banking?

Credit scoring, risk assessment, chatbots, fraud detection, and automation.

5. Is AI replacing jobs in the banking sector?

AI automates tasks but also creates new roles in data and tech fields.