Decoding the New Tax Regime | Is It Really For You?

Alright, let’s talk taxes. Specifically, the new tax regime . I know, I know, your eyes might be glazing over already. But here’s the thing: this isn’t just about filling out forms.

Thank you for reading this post, don't forget to subscribe!It’s about how much money you get to keep in your pocket. And honestly, who doesn’t want more of that? The government keeps tweaking things, so it pays to stay informed.

So, the big question is: should you switch? That’s what everyone’s asking. What fascinates me is how much confusion there still is around this, even though it’s been around for a while. Let’s break it down, step-by-step, and figure out if the revised tax slabs are a good fit for your financial life.

The “Why” Behind the Change | More Than Just Simplicity

Initially, the new tax regime was touted as a simpler alternative. Less paperwork, fewer deductions to worry about. Sounds great, right? But, and this is a big ‘but’, it came at a cost: giving up most of the deductions and exemptions that many taxpayers rely on.

Think about your tax exemptions ; HRA, LTA, 80C investments – poof, gone! The government’s aim was to encourage a system with fewer complexities and potentially lower rates for some income groups.

But why? Well, the idea, in theory, is that a simpler system reduces tax evasion and makes compliance easier. It also potentially frees up more money for people to spend and invest as they see fit, rather than being tied to Specific investment vehicles just for tax benefits.

It’s about empowering the taxpayer, or so the story goes. Whether it works that way in practice is another question entirely. For example, understanding the income tax structure is still complex regardless of the regime.

Crunching the Numbers | New Tax Slabs vs. Old

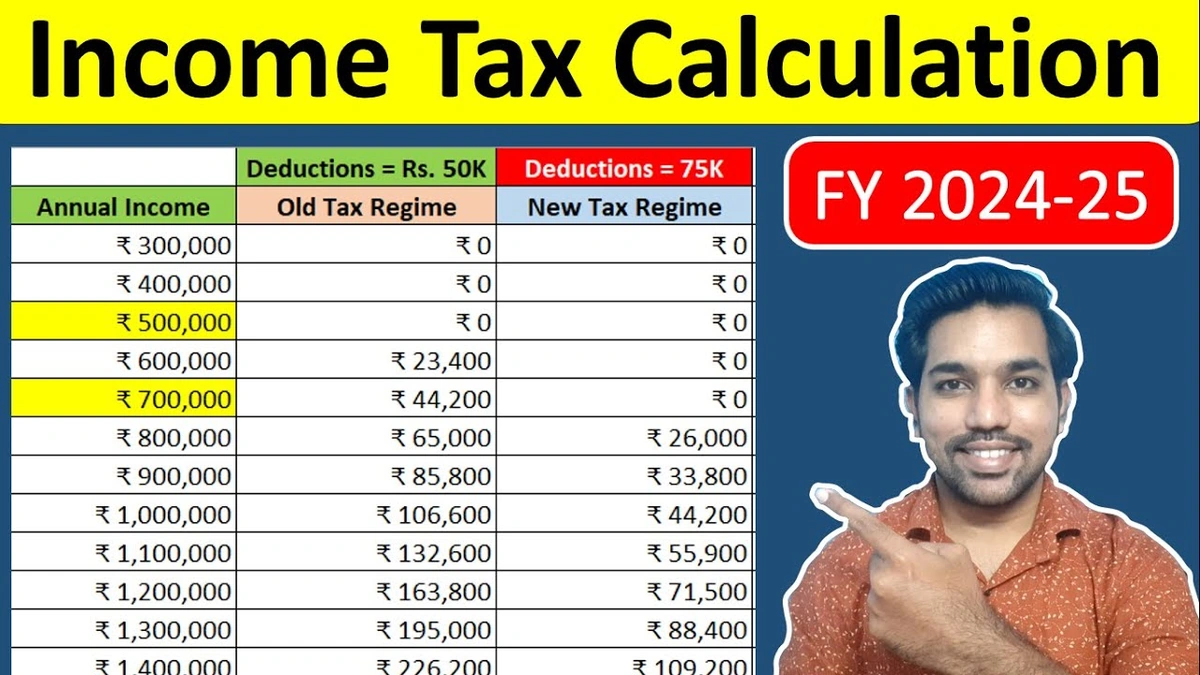

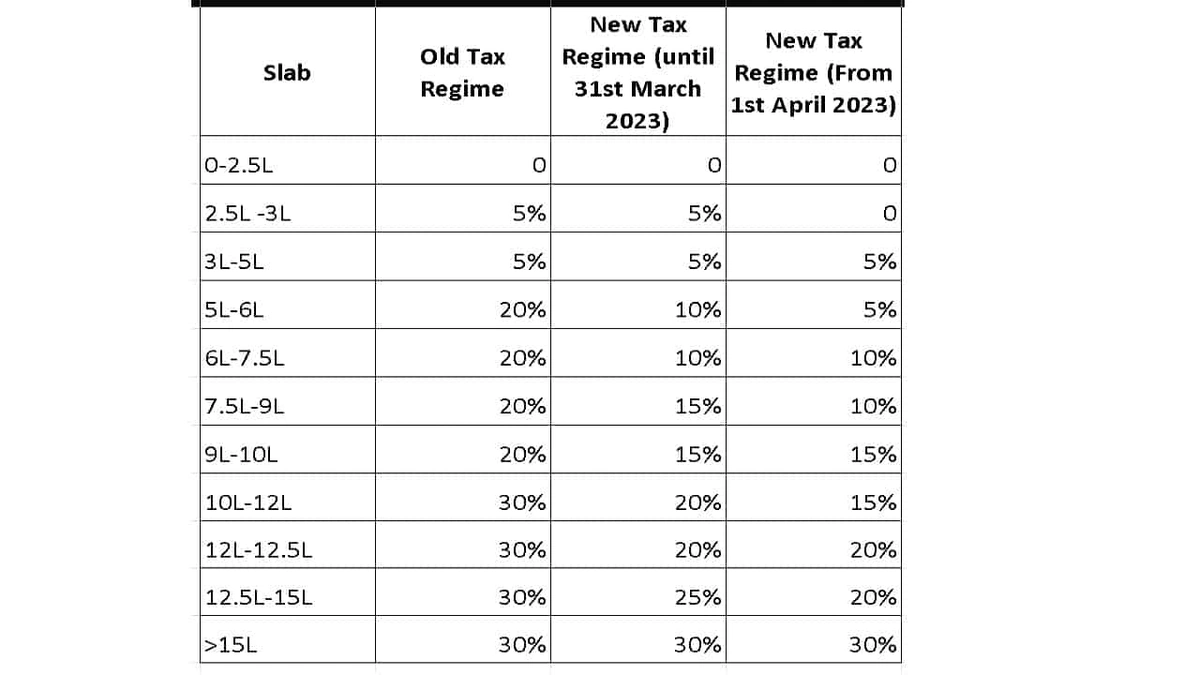

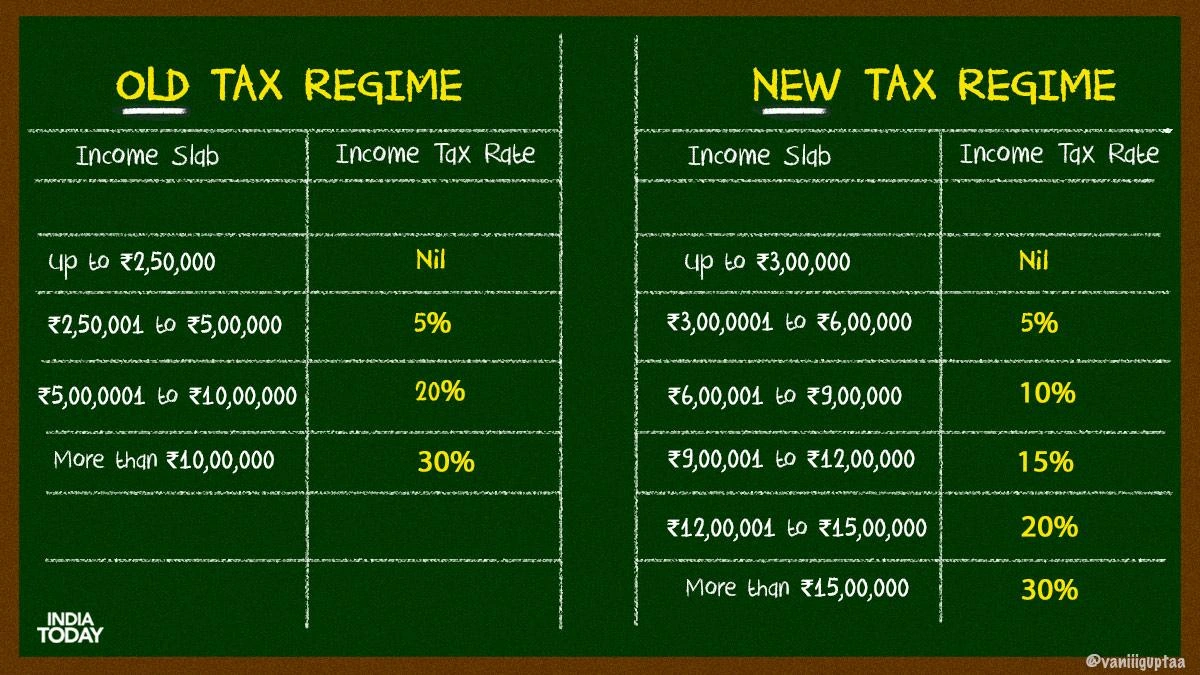

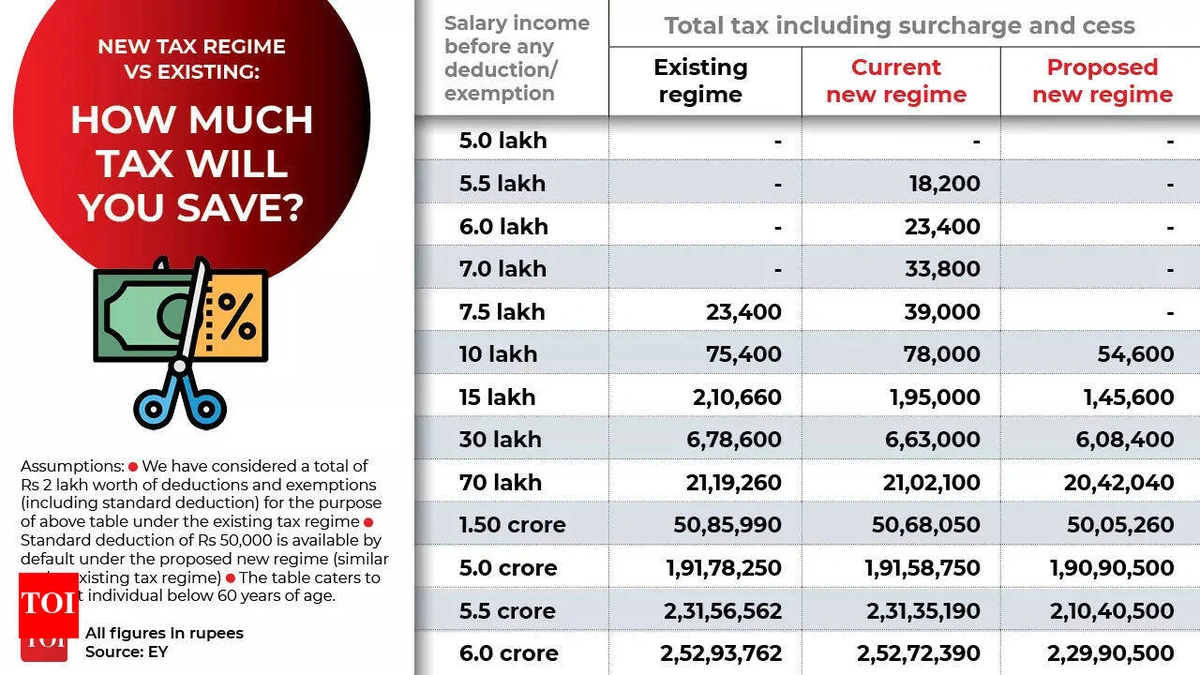

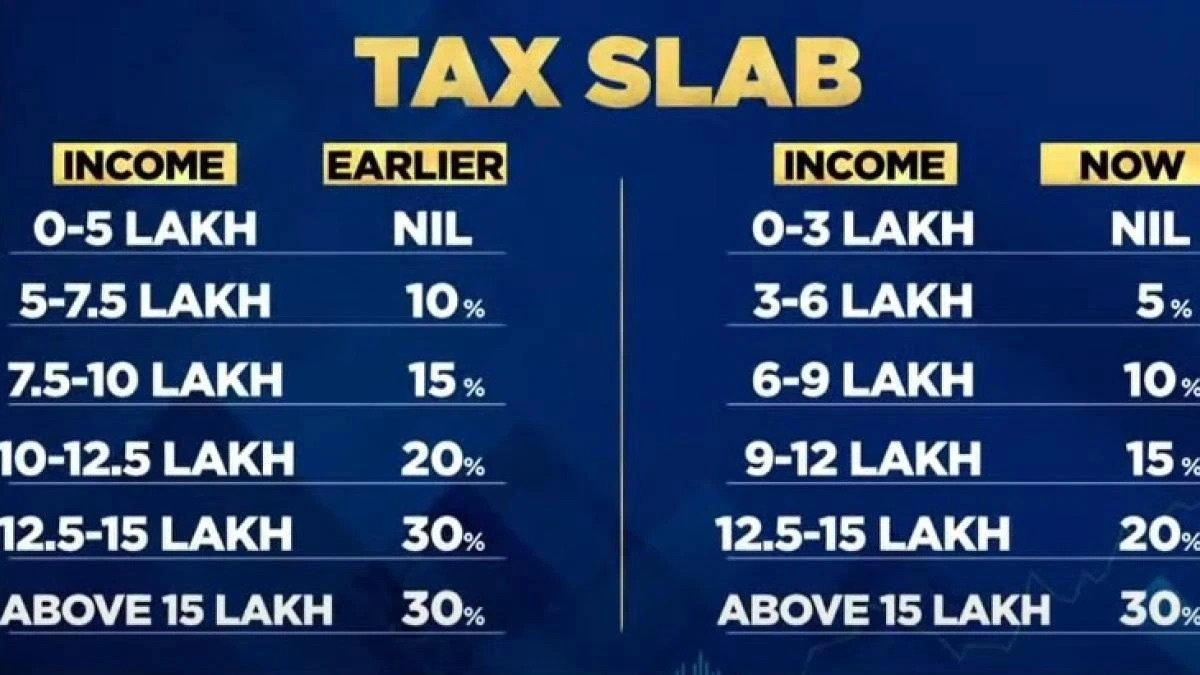

Okay, let’s get down to brass tacks. How do the actual numbers stack up? Here’s the gist: The new tax regime offers different tax slabs compared to the old one. These slabs define the tax rate applicable to different income ranges. Generally, the initial slabs in the new regime have lower tax rates.

For instance, under the new regime (as of the latest updates), income up to ₹3 lakh is tax-free. Then, the rates gradually increase as your income goes up. But, remember, this comes at the cost of forgoing those sweet, sweet deductions.

The old regime, while potentially having higher initial rates, allows you to reduce your taxable income significantly through deductions like investments in PPF, Insurance premiums, and house rent allowance. A common mistake I see people make is failing to accurately calculate their potential deductions under the old regime. Don’t fall into that trap!

The Deduction Dilemma | To Claim or Not To Claim?

This is where things get interesting, and where you really need to put on your thinking cap. The core of this decision hinges on whether you utilize a lot of the available tax deductions and exemptions under the old regime. Do you diligently invest in 80C instruments? Do you have a home loan with significant interest payments? Do you receive a hefty HRA? If the answer to most of these is ‘yes’, then the old regime might still be your best bet.

On the other hand, if you’re someone who doesn’t have many deductions to claim – maybe you’re just starting your career, or you prefer to keep your investments separate from tax considerations – then the new regime’s lower rates might be more attractive.

To make an informed decision, you absolutely must do the math. Calculate your taxable income under both regimes, factoring in all possible deductions, and see which one results in a lower tax liability. There are also tools and calculators available online to help with this, but always double-check their accuracy.

Making the Switch | Things to Consider

So, you’ve crunched the numbers, and you’re leaning towards the new income tax regime . Great! But before you take the plunge, here are a few things to keep in mind. Firstly, once you opt for the new regime, switching back to the old one might not always be possible, especially if you have business income.

The rules around this can be a bit tricky, so it’s crucial to understand the implications beforehand. The one thing you absolutely must double-check on is the specific form and procedure for opting into (or out of) the new regime.

Secondly, consider your long-term financial goals. Are you planning to buy a house soon? Will you be making significant investments in the near future? These factors can influence your decision, as they impact the amount of deductions you can claim.

The new regime might look good now, but if your financial situation changes drastically in the coming years, the old regime might become more advantageous. Think of it as a long game.

And, lastly, don’t be afraid to seek professional advice. A qualified tax advisor can provide personalized guidance based on your specific circumstances. They can help you navigate the complexities of the tax laws and make the best decision for your financial future.

Sometimes, paying a little for expert advice can save you a lot in the long run. You may also need to understand more about tax planning . So, consider it a worthwhile investment.

The Bottom Line | There’s No One-Size-Fits-All Answer

Let’s be honest, there’s no universal “right” answer here. The best tax regime for you depends entirely on your individual circumstances, your income level, your investment habits, and your long-term financial goals.

Don’t just blindly follow what your friends or colleagues are doing. Do your own research, crunch the numbers, and make an informed decision. Tax season doesn’t have to be a headache. The goal is to minimize taxes, not maximize complexity!

According to the latest notification from the IT department, there are some changes. So stay updated!

Finally, remember, the rules and regulations around taxes are constantly evolving. What’s true today might not be true tomorrow.

Stay informed, stay updated, and don’t be afraid to ask for help when you need it. Because when it comes to your money, you deserve to keep as much of it as possible.

Investing wisely is key no matter what tax bracket you are in.

Frequently Asked Questions (FAQs)

What if I forgot my application number?

Your application number is crucial. Typically, you can retrieve it through the official portal using your registered email/phone. Look for a “Forgot Application Number” link.

Is the new tax regime mandatory?

No, it is optional. You can choose between the old and new regimes based on what suits you best.

Can I switch back to the old regime if I don’t like the new one?

Yes, but there are certain conditions, especially if you have business income. Check the specific rules.

Where can I find the official notification about the new tax slabs?

Check the official website of the Income Tax Department of India. They usually have a dedicated section for notifications and circulars.

Are there any disadvantages to choosing the new tax regime?

Yes, primarily the loss of most deductions and exemptions available under the old regime. That is the main drawback.