Decoding the KOSPI Index | More Than Just Numbers

The KOSPI Index . You’ve probably heard of it. It’s that mysterious acronym that pops up on financial news, but what is it, really? And more importantly, why should anyone in India care about what’s happening on the Korean stock market? Here’s the thing: understanding the KOSPI isn’t just about Korea; it’s about understanding global market trends, and how they ripple across the world, impacting your investments and the economy.

Thank you for reading this post, don't forget to subscribe!I initially thought it was straightforward, but then I realized the KOSPI holds a wealth of information about global economics – specifically how East Asian markets are performing. So, let’s dive in, shall we?

What Exactly Is the KOSPI Index?

Okay, let’s break it down. KOSPI stands for Korea Composite Stock Price Index . It’s the stock market index of South Korea, representing all common stocks traded on the Korea Exchange. Think of it like India’s Sensex or Nifty 50 – it’s a benchmark. It essentially shows the overall performance of the South Korean stock market. A rising KOSPI generally indicates a healthy and growing Korean economy, while a falling KOSPI suggests the opposite.

But and here’s where it gets interesting the KOSPI isn’t just about Korean companies. It includes major global players with significant operations in Korea, meaning its movements can reflect broader international economic conditions.

Why Should India Care About the KOSPI?

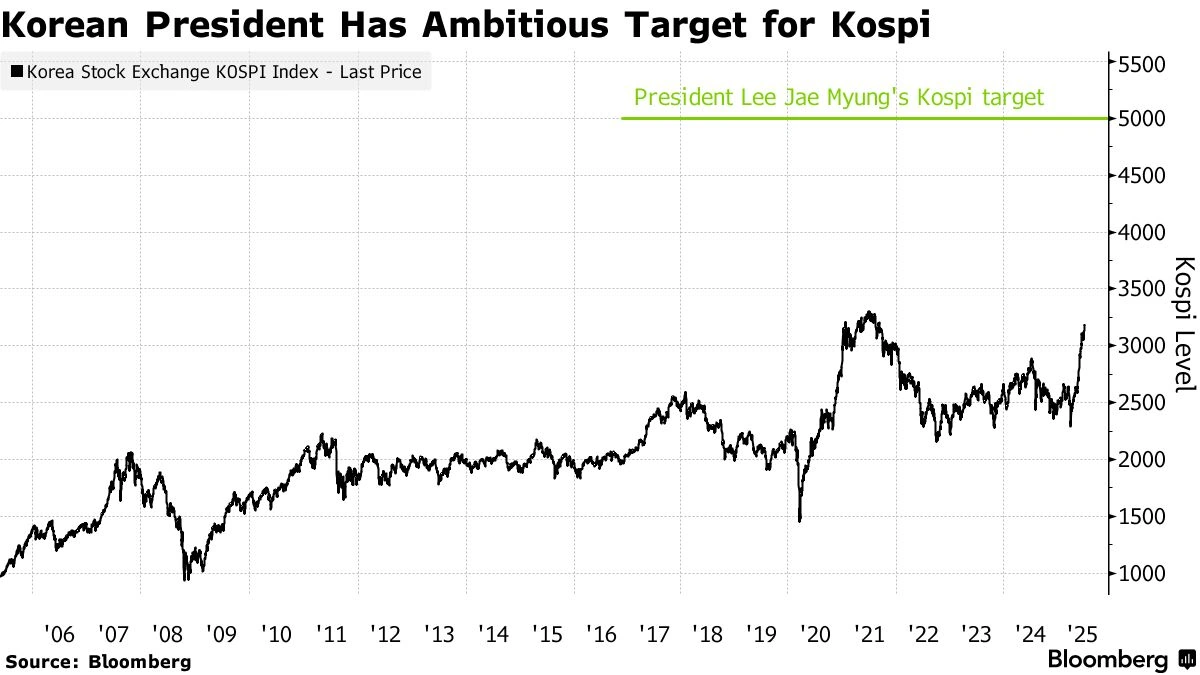

Now, for the million-dollar question: why should you, sitting in India, bother with what the KOSPI is doing? Well, for several key reasons. Firstly, the KOSPI is often viewed as a leading indicator for other Asian markets, including India. Because South Korea is a major exporting nation, its stock market is highly sensitive to global demand.

Global Market Trends are heavily impacted by the KOSPI. What fascinates me is that a downturn in the KOSPI can signal potential slowdowns in international trade and economic growth, which will eventually affect India. If Korean companies are struggling, that could mean reduced demand for Indian goods and services and vice versa.

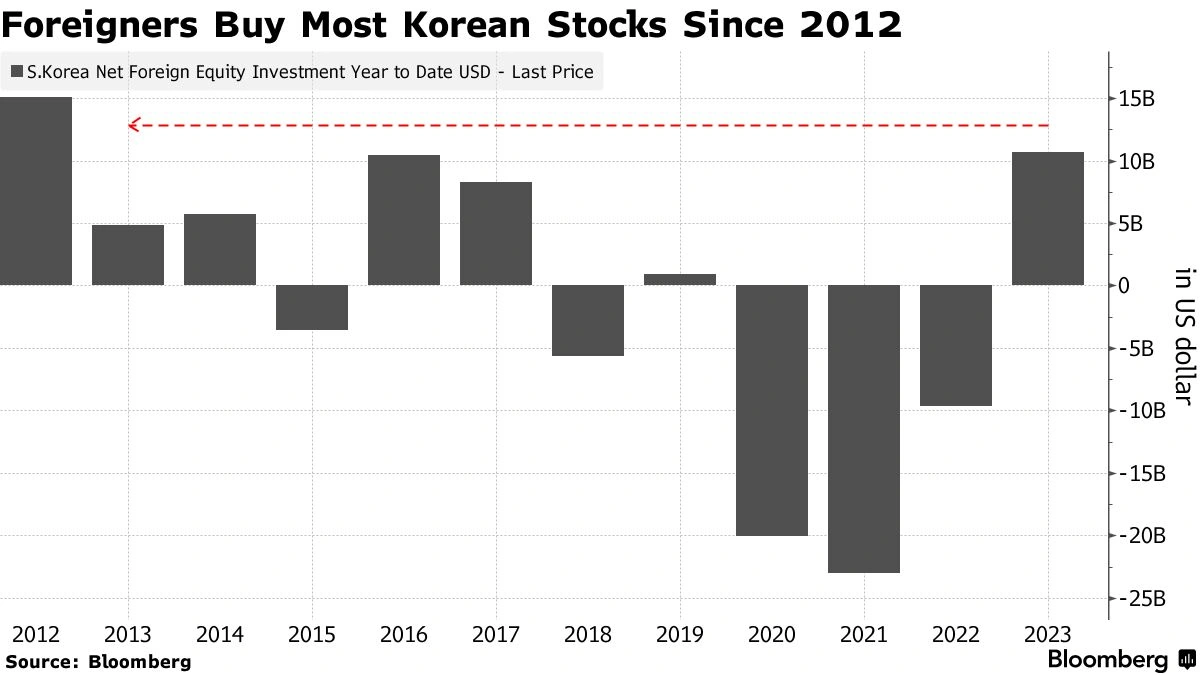

Secondly, many Indian investors have exposure to global funds that include Korean stocks. So, the performance of the KOSPI directly affects the returns on those investments. A common mistake I see people make is not considering international market correlations when building their portfolios. Diversification is key, but understanding how different markets interact is crucial.

Finally, the KOSPI provides valuable insights into the health of specific industries. For example, South Korea is a major player in the technology and automobile sectors. Tata Capital If the KOSPI shows these sectors are struggling, it might be a sign that those industries are facing global headwinds, which could impact Indian companies in similar sectors.

Understanding the KOSPI | Key Factors and Influences

So, what drives the KOSPI? Several factors are in play here. Economic indicators like GDP growth, inflation, and unemployment rates in Korea have a direct impact. Monetary policy decisions by the Bank of Korea are also critical. Interest rate hikes, for example, can dampen investor sentiment and lead to a KOSPI decline.

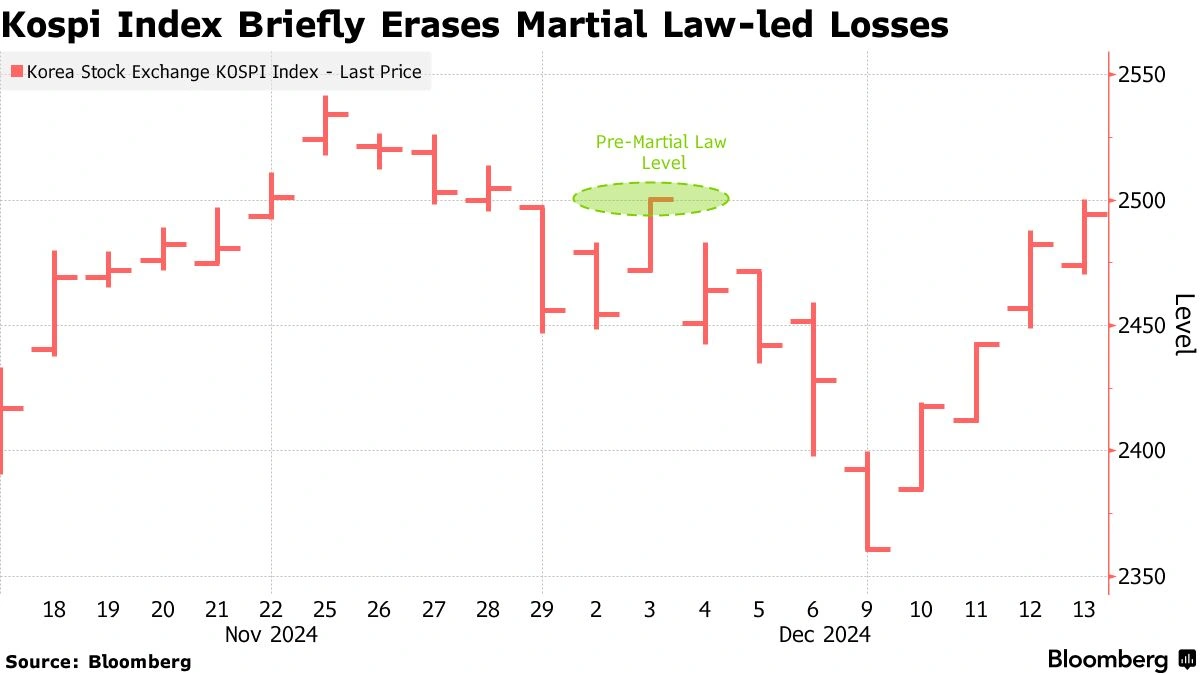

But it’s not just about Korea. Global events, such as changes in US interest rates, trade wars, and geopolitical tensions, can also significantly influence the KOSPI. South Korea’s export-oriented economy makes it particularly vulnerable to shifts in global trade dynamics. According to reports, the semiconductor industry plays a big role in the Korean economy, and the semiconductor industry also affects the KOSPI.

Exchange Rate Fluctuations , specifically the value of the Korean Won against the US dollar, also play a role. A weaker Won can boost exports but can also lead to inflationary pressures.

How to Track and Interpret the KOSPI in India

Okay, let’s get practical. How can you, as an Indian investor or businessperson, keep an eye on the KOSPI and make sense of its movements?

Firstly, follow reputable financial news sources that provide coverage of international markets. Websites like Bloomberg, Reuters, and the Financial Times offer real-time KOSPI data and analysis. Many Indian financial news outlets also provide updates on key global indices.

Secondly, understand the context behind the numbers. Don’t just look at whether the KOSPI is up or down. Dig deeper. Read the news reports and analysis to understand why it’s moving. Is it due to a specific economic announcement, a geopolitical event, or a change in investor sentiment?

Finally, compare the KOSPI to other Asian indices, such as the Nikkei (Japan) and the Hang Seng (Hong Kong). This can give you a broader perspective on the overall health of the Asian economy. Waaree Energies Share is another good indicator of investment trends.

The KOSPI and its Impact on Indian Investments

Let’s be honest, the KOSPI’s performance can indirectly impact your investments. If you’re invested in international funds that hold Korean stocks, a downturn in the KOSPI could negatively affect your returns. A portfolio diversification will help mitigate this.

However, it’s important to remember that the KOSPI is just one piece of the puzzle. Don’t make investment decisions based solely on its movements. Consider the bigger picture, including your own risk tolerance, investment goals, and overall portfolio strategy.

While sources suggest a specific time, the official confirmation is still pending. It’s best to keep checking the official portal. But understanding that market changes can influence investments can help create a good defense for your portfolio.

FAQ | Understanding the KOSPI Index

What is the KOSPI’s trading time?

The Korea Exchange’s trading hours are typically from 9:00 AM to 3:30 PM Korean Standard Time (KST), Monday to Friday.

How is the KOSPI calculated?

The KOSPI is a market-capitalization-weighted index. This means that companies with larger market capitalizations have a greater influence on the index’s value.

What are some major companies listed on the KOSPI?

Some of the largest companies listed on the KOSPI include Samsung Electronics, SK Hynix, and Hyundai Motor.

Is the KOSPI a good indicator of the overall Korean economy?

Yes, the KOSPI is generally considered a good indicator of the overall health of the South Korean economy, but it’s not the only indicator. Other factors, such as GDP growth and employment rates, should also be considered.

How often is the KOSPI updated?

The KOSPI is updated in real-time during trading hours.

Can I directly invest in the KOSPI from India?

No, you cannot directly invest in the KOSPI. However, you can invest in international funds or ETFs that hold Korean stocks.

So, there you have it. The KOSPI Index isn’t just some obscure number on a screen. It’s a window into the global economy, a potential early warning system, and a valuable tool for understanding market trends. By keeping an eye on the KOSPI, you can gain a deeper understanding of the forces shaping the world around you – and make smarter investment decisions along the way.