Best Free Budgeting Apps 2025 –Top Personal Finance Tools.

Best Free Budgeting Apps 2025 managing personal finances has become more accessible than ever, thanks to a wide array of free budgeting apps designed to help individuals track spending, save money, and achieve financial goals.

Thank you for reading this post, don't forget to subscribe!With the cost of living rising and economic uncertainties persisting, budgeting apps offer a practical solution for staying on top of your finances without breaking the bank.

This article explores the best free budgeting apps for 2025, focusing on their features, usability, and suitability for different financial needs.

Drawing from recent analyses and user feedback, we highlight the top options that stand out for their functionality, accessibility, and effectiveness in helping users take control of their money.

The Importance of Best Free Budgeting Apps 2025

Budgeting apps have transformed personal finance by automating tedious tasks like expense tracking, categorizing spending, and setting savings goals. In 2025, these apps are more sophisticated, leveraging artificial intelligence (AI), open banking, and seamless bank account syncing to provide real-time insights.

Free budgeting apps are particularly valuable for beginners, students, and those looking to manage their finances without committing to costly subscriptions. The best apps offer robust features, intuitive interfaces, and high user ratings, making them essential tools for Financial planning in today’s fast-paced world.

Criteria for Selecting the Best Free Budgeting Apps

To identify the top Best Free Budgeting Apps 2025, we consider the following factors:

- Cost: Must offer a free plan with meaningful functionality, not just a trial.

- Features: Ability to track spending, create budgets, sync bank accounts, and provide insights.

- User Experience: Intuitive design, ease of navigation, and accessibility across devices.

- Security: Robust encryption and data protection to ensure user safety.

- User Ratings: High ratings (at least 4.0 stars) on iOS and Google Play with significant reviews.

- Budgeting Method: Support for popular budgeting approaches like zero-based or envelope budgeting.

- Customization: Flexibility to create custom categories and goals.

Based on these criteria, the following are the best free budgeting apps for 2025, with detailed profiles of their features, strengths, and ideal use cases.

Top Free Budgeting Apps for 2025

1. EveryDollar (Free Version)

Overview: Best Free Budgeting Apps 2025 EveryDollar, developed by personal finance expert Dave Ramsey, is a leading budgeting app that employs the zero-based budgeting method, where every dollar of income is assigned a purpose. The free version is robust enough for beginners and has a 4.7-star rating on iOS (66,000+ reviews) and 3.8 stars on Android (11,000+ reviews).

Key Features:

- Zero-Based Budgeting: Users allocate every dollar to categories like rent, groceries, or savings, ensuring no money is unaccounted for.

- Customizable Categories: Create unlimited budget categories to match personal spending habits.

- Manual Transaction Entry: The free version requires users to manually input transactions, fostering mindful spending.

- Savings Goals: Track progress toward goals like emergency funds or debt repayment.

- Accessibility: Available on iOS, Android, and web browsers.

Strengths:

- Simple, user-friendly interface that’s easy to navigate for budgeting novices.

- Aligns with Dave Ramsey’s proven financial philosophy, ideal for debt payoff.

- Free version offers core budgeting tools without a time limit, unlike many competitors.

Limitations:

- No automatic bank syncing in the free version (available in the premium version for $79.99/year or $17.99/month after a 14-day trial).

- Limited reporting features compared to paid apps.

Who It’s For: EveryDollar’s free version is perfect for those who prefer a hands-on approach to budgeting, follow zero-based budgeting, or are focused on paying off debt. It’s especially suited for users who don’t mind manual transaction entry and want a straightforward tool.

Why Choose EveryDollar?: Its simplicity and alignment with a proven budgeting method make it a top choice for disciplined budgeters seeking a free solution.

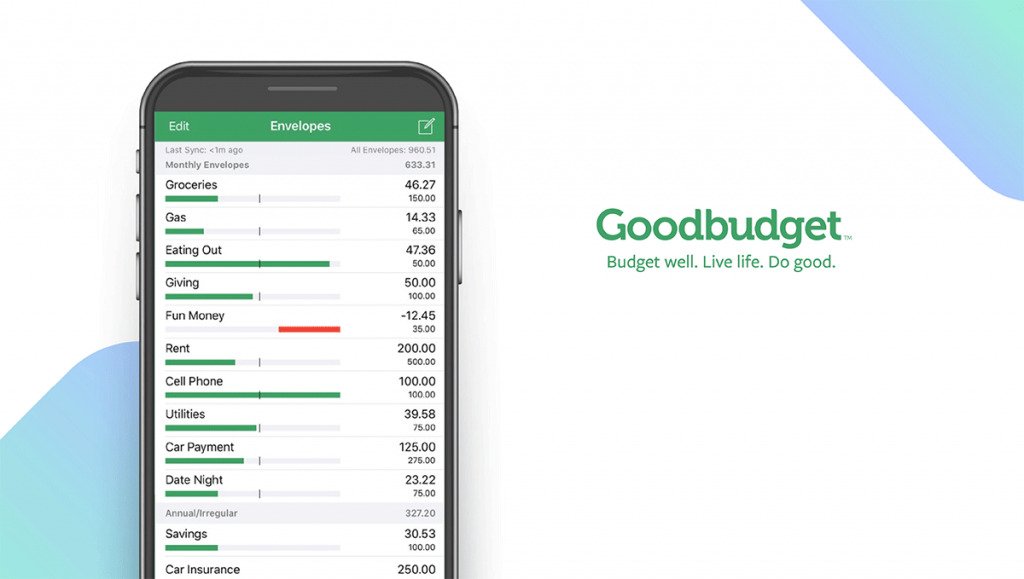

2. Goodbudget (Free Version)

Overview: Best Free Budgeting Apps 2025 Goodbudget is a digital take on the envelope budgeting system, where income is divided into virtual “envelopes” for specific categories. Its free version is highly rated, with 4.6 stars on iOS and 4.1 stars on Android, and is praised for its simplicity and effectiveness.

Key Features:

- Envelope Budgeting: Allocate funds to categories like groceries, rent, or entertainment, with visual indicators (red envelopes) for overspending.

- Manual Transaction Tracking: Users enter transactions manually, promoting conscious spending.

- One-Year Transaction History: Track spending patterns for up to a year in the free version.

- Cross-Device Syncing: Share budgets with family or partners across devices.

- Accessibility: Available on iOS, Android, and web platforms.

Strengths:

- Ideal for users who prefer the traditional envelope system without physical cash.

- No bank account syncing required, appealing to those concerned about data privacy.

- Simple design makes it accessible for budgeting beginners.

Limitations:

- No automatic transaction imports in the free version (available in Goodbudget Plus for $6/month or $50/year).

- Limited to 10 regular and 10 debt envelopes in the free plan.

Who It’s For: Goodbudget is best for individuals or families who want a digital envelope system, prefer manual tracking, or prioritize data privacy by avoiding bank syncing.

Why Choose Goodbudget?: Its straightforward approach and privacy focus make it a great free option for disciplined budgeters who like the envelope method.

3. WalletHub

Overview: WalletHub is a versatile free budgeting app that offers a range of financial tools beyond budgeting, including credit score monitoring and spending tracking. It has a 4.5-star rating on iOS and 4.0 stars on Android, with strong user approval for its comprehensive features.

Key Features:

- Customizable Budgets: Choose from multiple budgeting styles, including zero-based and envelope methods.

- Manual Transaction Entry: Add transactions manually or use a transaction importer.

- Credit Monitoring: Free access to credit scores, reports, and net worth tracking.

- Spending Insights: Categorize expenses and receive personalized budgeting tips.

- Accessibility: Available on iOS, Android, and web platforms.

Strengths:

- Combines budgeting with credit monitoring and financial planning tools at no cost.

- Flexible budgeting styles cater to different user preferences.

- Strong security measures, including encryption and secure data storage.

Limitations:

- No automatic bank syncing in the free version, which may be inconvenient for some users.

- Fewer advanced features compared to paid apps like YNAB or Monarch Money.

Who It’s For: WalletHub is ideal for users who want a free, all-in-one financial tool that combines budgeting with credit score tracking and financial insights.

Why Choose WalletHub?: Its comprehensive free features and flexibility make it a standout for budgeters seeking additional financial tools without a subscription.

4. Rocket Money (Free Version)

Overview: Best Free Budgeting Apps 2025 Rocket Money, a popular Mint alternative, offers a free version focused on subscription management and basic budgeting. It has a 4.7-star rating on iOS (4.5 stars on Android) and is lauded for its intuitive interface.

Key Features:

- Subscription Tracking: Identifies and helps cancel unwanted subscriptions.

- Manual Budgeting: Create budgets and track spending manually in the free version.

- Spending Insights: Provides graphs and reports to visualize spending patterns.

- Bill Alerts: Notifies users of upcoming bills and potential increases.

- Accessibility: Available on iOS, Android, and web platforms.

Strengths:

- Excellent for identifying and managing recurring subscriptions, helping users save money.

- Intuitive design with clear visualizations of spending.

- Free version includes core budgeting and bill tracking features.

Limitations:

- Limited functionality without the premium version ($6-$12/month), which includes bank syncing and bill negotiation.

- Short seven-day trial for premium features.

Who It’s For: Rocket Money is best for users looking to cut unnecessary subscriptions, track bills, and create basic budgets without committing to a paid plan.

Why Choose Rocket Money?: Its focus on subscription management and user-friendly interface make it a great free tool for cost-conscious users.

5. SoFi Relay

Overview: SoFi Relay, accessible through the SoFi app, is a free budgeting tool that integrates spending tracking, savings goals, and credit score monitoring. It has a 4.5-star rating on iOS and 4.0 stars on Android, appealing to users seeking a comprehensive free solution.

Key Features:

- Bank Account Syncing: Links to external accounts for real-time spending tracking.

- Budget Planning: Create budgets based on income and expenses, with historical trend analysis.

- Credit Score Monitoring: Free access to credit scores without impacting them.

- Financial Coaching: Access to financial experts for personalized advice.

- Accessibility: Available on iOS, Android, and web via SoFi.com.

Strengths:

- Fully free with no premium upsell, offering robust features like bank syncing.

- Combines budgeting with credit monitoring and financial planning.

- Secure data storage with physical and electronic protections.

Limitations:

- Requires a SoFi account, though no banking products are necessary.

- Less customizable than apps like YNAB or Goodbudget.

Who It’s For: SoFi Relay is ideal for users who want a free app with automatic bank syncing and additional financial tools like credit monitoring.

Why Choose SoFi Relay?: Its no-cost, feature-rich approach makes it a top choice for tech-savvy budgeters seeking automation.

Comparative Analysis of Free Budgeting Apps

| App | Budgeting Method | Bank Syncing | Key Features | Best For | Limitations |

|---|---|---|---|---|---|

| EveryDollar | Zero-Based | No (Free) | Custom categories, savings goals | Debt payoff, hands-on budgeting | Manual entry, limited reports |

| Goodbudget | Envelope | No | Envelope system, cross-device sync | Privacy-conscious, envelope users | Limited envelopes, no auto-sync |

| WalletHub | Flexible | No (Free) | Credit monitoring, customizable budgets | All-in-one financial tracking | No auto-sync |

| Rocket Money | Flexible | No (Free) | Subscription tracking, bill alerts | Subscription management | Limited free features |

| SoFi Relay | Flexible | Yes | Bank syncing, credit monitoring | Automated tracking, beginners | Requires SoFi account |

Choosing the Right Free Budgeting App

Best Free Budgeting Apps 2025 Selecting the best free budgeting app depends on your financial goals and preferences:

- For Debt Payoff: EveryDollar’s zero-based budgeting is ideal for disciplined debt reduction.

- For Privacy-Conscious Users: Goodbudget’s manual entry ensures data security without bank syncing.

- For Comprehensive Financial Tools: WalletHub and SoFi Relay offer credit monitoring and budgeting in one package.

- For Subscription Management: Rocket Money excels at identifying and canceling unwanted subscriptions.

- For Automation: SoFi Relay’s bank syncing and real-time tracking suit users who prefer minimal manual input.

Tips for Maximizing Free Budgeting Apps

- Commit to Regular Updates: For apps requiring manual entry (e.g., EveryDollar, Goodbudget), update transactions daily to maintain accuracy.

- Set Realistic Goals: Use savings goals and spending limits to align with your financial priorities.

- Leverage Insights: Review spending reports and graphs to identify overspending patterns.

- Explore Free Features: Many apps offer robust free tools; explore all features before considering premium upgrades.

- Combine with Financial Education: Pair apps with resources like blogs or podcasts (e.g., Dave Ramsey for EveryDollar users) to enhance financial literacy.

The Future of Free Budgeting Apps

Best Free Budgeting Apps 2025, free budgeting apps are expected to evolve further, with trends including:

- AI Integration: Apps like Cleo and Copilot are already using AI for predictive budgeting, a feature likely to expand in free versions.

- Open Banking: More apps will leverage open banking for seamless account integration, as seen in SoFi Relay.

- Gamification: Free apps may incorporate gamified savings challenges to engage younger users.

- Financial Inclusion: Apps will focus on underserved populations, offering multilingual support and simplified interfaces.

Conclusion

The best free budgeting apps of 2025—EveryDollar, Goodbudget, WalletHub, Rocket Money, and SoFi Relay—offer powerful tools to manage finances without costing a dime.

Whether you’re paying off debt, tracking subscriptions, or seeking a comprehensive financial overview, these apps cater to diverse needs with intuitive designs and robust features.

Best Free Budgeting Apps 2025 By choosing an app that aligns with your budgeting style and financial goals, you can take control of your money, reduce financial stress, and work toward a secure future.

Start with one of these apps today, explore its features, and build a budget that empowers you to achieve your financial dreams.