How Does Hourly Pay Differ from Salary?

In the modern workforce, Salary structures play a critical role in shaping an employee’s financial stability, work-life balance, and job satisfaction. Two primary methods of compensation dominate the employment landscape: hourly pay and salary. While both serve to remunerate workers for their time and effort, they differ significantly in structure, benefits, flexibility, and implications for employees and employers. Understanding these distinctions is essential for workers navigating career choices and for businesses designing equitable compensation systems. This article explores the key differences between hourly pay and salary, delving into their mechanics, advantages, disadvantages, and broader impacts.

Thank you for reading this post, don't forget to subscribe!Defining Hourly Pay and Salary

Hourly pay refers to compensation based on the number of hours an employee works. Employees paid hourly receive a fixed rate for each hour worked, and their total earnings depend on the hours logged in a pay period. For example, an employee earning $20 per hour who works 40 hours in a week earns $800 before taxes. Hourly pay is common in industries like retail, hospitality, construction, and entry-level roles, where work hours may vary.

Salary, in contrast, is a fixed annual amount paid to an employee, typically divided into equal installments over regular pay periods (e.g., biweekly or monthly). A salaried employee earning $60,000 annually might receive $2,500 per month, regardless of the exact hours worked. Salaries are prevalent in professional, managerial, and administrative roles, such as accounting, marketing, or corporate management, where employees are often expected to complete tasks rather than adhere to strict hourly schedules.

Payment Structure and Flexibility

The most fundamental difference between hourly pay and salary lies in how compensation is calculated. Hourly pay is inherently tied to time worked, offering a direct correlation between effort and earnings. If an hourly employee works overtime—typically defined as hours exceeding 40 per week in the United States—they are entitled to overtime pay, often at 1.5 times their regular rate, as mandated by the Fair Labor Standards Act (FLSA). For example, an employee earning $15 per hour would receive $22.50 per hour for overtime. This structure incentivizes workers to take on extra hours when needed but can lead to unpredictable income if hours fluctuate.

Salaried employees, however, receive a consistent paycheck regardless of hours worked. This predictability provides financial stability, particularly for budgeting and long-term planning. However, salaried roles often come with an expectation of flexibility in hours. A salaried employee may work 50 or 60 hours in a busy week without additional compensation, as their pay is fixed. Conversely, during lighter periods, they may work fewer hours without a reduction in pay, provided their work meets expectations.

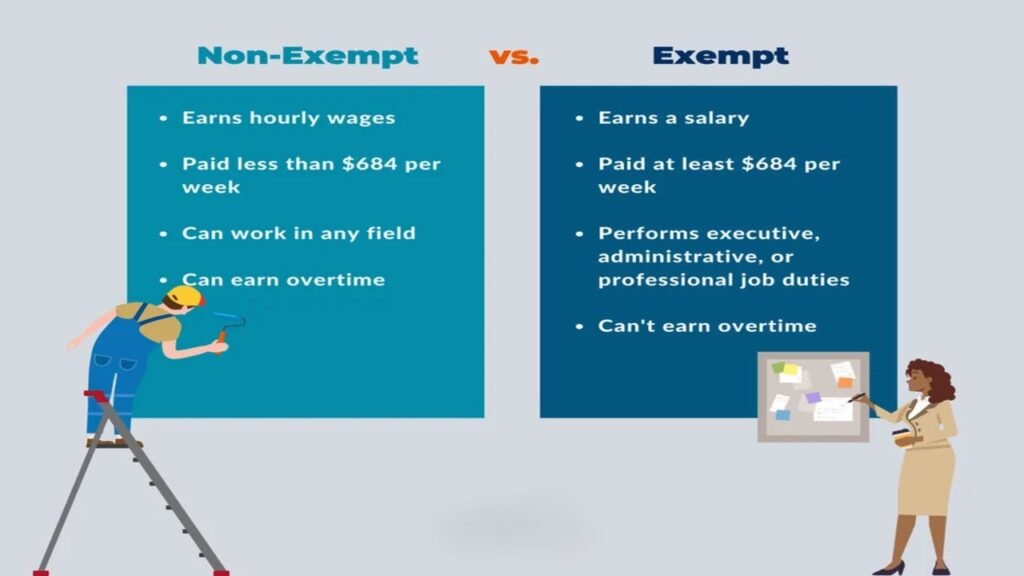

Classification: Exempt vs. Non-Exempt

A key legal distinction between hourly and salaried employees relates to their classification under labor laws, particularly in the U.S. Hourly workers are typically classified as non-exempt under the FLSA, meaning they are entitled to overtime pay and other protections, such as minimum wage. Non-exempt employees must track their hours meticulously, often through timecards or digital systems, to ensure accurate payment.

Salaried employees may be classified as exempt or non-exempt, depending on their job duties and salary level. Exempt salaried employees—often in professional, executive, or administrative roles—are not eligible for overtime pay, provided they meet specific criteria, such as earning above a certain salary threshold ($43,888 annually as of 2025) and performing duties like managing teams or making high-level decisions. Non-exempt salaried employees, though less common, are entitled to overtime pay, similar to hourly workers. This classification significantly impacts how employers structure compensation and manage workloads.

Benefits and Perks

Benefits packages often differ between hourly and salaried employees, though this varies by employer. Salaried employees, particularly in professional roles, are more likely to receive comprehensive benefits, such as health insurance, paid time off (PTO), retirement plans, and bonuses. These benefits reflect the long-term commitment employers expect from salaried workers, who are often seen as integral to organizational goals. For example, a salaried marketing manager might receive 15 days of PTO, a 401(k) match, and performance-based bonuses.

Hourly employees, particularly in part-time or entry-level roles, may have limited access to benefits. Many hourly workers, especially in retail or service industries, receive minimal or no paid vacation, health insurance, or retirement contributions. However, some employers offer prorated benefits to hourly workers, such as health insurance for those working a minimum number of hours (e.g., 30 hours per week). The gig economy and unionized workplaces have pushed for better benefits for hourly workers, but disparities persist compared to salaried roles.

Work-Life Balance and Expectations

Hourly and salaried positions often carry different expectations regarding work-life balance. Hourly employees typically have defined schedules, with clear start and end times. Once their shift ends, they are generally free from work responsibilities, allowing for a clearer separation between work and personal life. However, hourly workers may face challenges like irregular schedules or last-minute shift changes, particularly in industries like hospitality, which can disrupt personal planning.

Salaried employees often face less rigid schedules but higher expectations for availability. Employers may expect salaried workers to respond to emails after hours, attend meetings outside regular schedules, or take on additional projects without extra pay. This can lead to longer hours and potential burnout, particularly in high-pressure industries like finance or technology. However, salaried roles often offer greater autonomy and flexibility, such as the ability to work from home or adjust schedules to accommodate personal needs, provided work is completed.

Job Security and Career Progression

Job security can differ significantly between hourly and salaried roles. Hourly positions, especially in industries with seasonal or variable demand, may offer less stability. For example, retail workers may face reduced hours during slow periods, directly impacting their income. Layoffs or shift reductions can also occur with little notice, making financial planning challenging.

Salaried positions, particularly in professional or managerial roles, often come with greater job security due to the employee’s integral role in the organization. Salaried employees are typically hired with a long-term perspective, and their fixed compensation provides stability during economic downturns. Additionally, salaried roles often offer clearer paths to career progression, with opportunities for promotions, raises, and leadership roles. Hourly workers, while able to advance in some industries (e.g., from cashier to store manager), may face more limited upward mobility without transitioning to salaried positions.

Tax Implications and Financial Planning

Both hourly and salaried employees are subject to similar tax structures, but the predictability of income affects financial planning. Hourly workers face variable income, particularly if hours fluctuate, making it harder to budget or save consistently. For example, an hourly worker earning $18 per hour might earn $720 in a 40-hour week but only $540 in a 30-hour week, creating uncertainty. They must also track overtime earnings, which are taxed at the same rate as regular income but can push them into a higher tax bracket.

Salaried employees benefit from predictable paychecks, simplifying budgeting and long-term financial planning. However, their fixed income means they cannot easily increase earnings through extra hours, unlike hourly workers with overtime opportunities. Both groups must account for deductions like income tax, Social Security, and Medicare, but salaried employees may have access to pre-tax benefits (e.g., health savings accounts or 401(k) contributions) that reduce taxable income.

Employer Considerations

From an employer’s perspective, choosing between hourly and salaried compensation depends on the nature of the work and business needs. Hourly pay suits roles with variable workloads or seasonal demand, such as retail during holidays or construction during peak seasons. It allows employers to scale labor costs with demand, paying only for hours worked. However, managing hourly workers requires robust scheduling and time-tracking systems to ensure compliance with labor laws.

Salaried positions are ideal for roles requiring consistent effort, long-term commitment, or specialized skills. Employers benefit from predictable labor costs and can expect greater flexibility from salaried employees. However, offering competitive salaries and benefits can be costlier upfront, and employers must ensure exempt salaried employees meet FLSA criteria to avoid legal issues.

Cultural and Industry Variations

The prevalence of hourly versus salaried pay varies by industry and region. In the U.S., hourly pay dominates in service-oriented sectors like retail (e.g., Walmart cashiers), food service (e.g., baristas), and manual labor (e.g., construction workers). Salaried roles are more common in white-collar industries like finance, technology, and education. Globally, cultural attitudes toward work influence compensation. For example, European countries with strong labor protections may offer salaried-like benefits (e.g., paid leave) to hourly workers, while developing economies may rely heavily on hourly or daily wages in informal sectors.

Advantages and Disadvantages

Hourly Pay Advantages:

- Overtime pay for extra hours.

- Clear separation between work and personal time.

- Flexibility for part-time or seasonal work.

Hourly Pay Disadvantages:

- Unpredictable income due to fluctuating hours.

- Limited access to benefits in some roles.

- Less job security in variable-demand industries.

Salary Advantages:

- Predictable income for easier budgeting.

- Comprehensive benefits packages.

- Greater job security and career growth potential.

Salary Disadvantages:

- No overtime pay for extra hours.

- Higher expectations for availability.

- Potential for burnout in demanding roles.

Conclusion

The choice between hourly pay and salary depends on individual preferences, career goals, and lifestyle needs. Hourly pay offers flexibility and the potential for overtime earnings but comes with income variability and fewer benefits. Salary provides stability, comprehensive benefits, and career advancement opportunities but often demands greater availability and responsibility. Both systems have unique strengths and challenges, and understanding these differences empowers workers to make informed career decisions and employers to design fair compensation structures. As the workforce evolves with gig economy trends and remote work, the lines between hourly and salaried pay may blur, but their core distinctions will continue to shape the employment landscape.