Decoding Forex Factory News | What It Really Means for Indian Traders

Okay, let’s be honest. When you first stumble upon Forex Factory news , it can feel like you’ve walked into a room where everyone’s speaking a language you vaguely understand, but can’t quite grasp. There are charts, economic calendars, and a whole lot of jargon. So, the big question is: why should an Indian trader, perhaps just starting out, even care about Forex Factory? The answer, my friend, is that it’s a goldmine if you know how to pan for it.

Thank you for reading this post, don't forget to subscribe!Here’s the thing: it’s not just about the ‘what’ – the release of economic data or a central bank announcement. It’s about the ‘why’ and, more importantly, the ‘how’ it’ll impact your trades. I remember when I started trading, I’d see these announcements and think, “Okay, cool. But what does it mean for the rupee?”

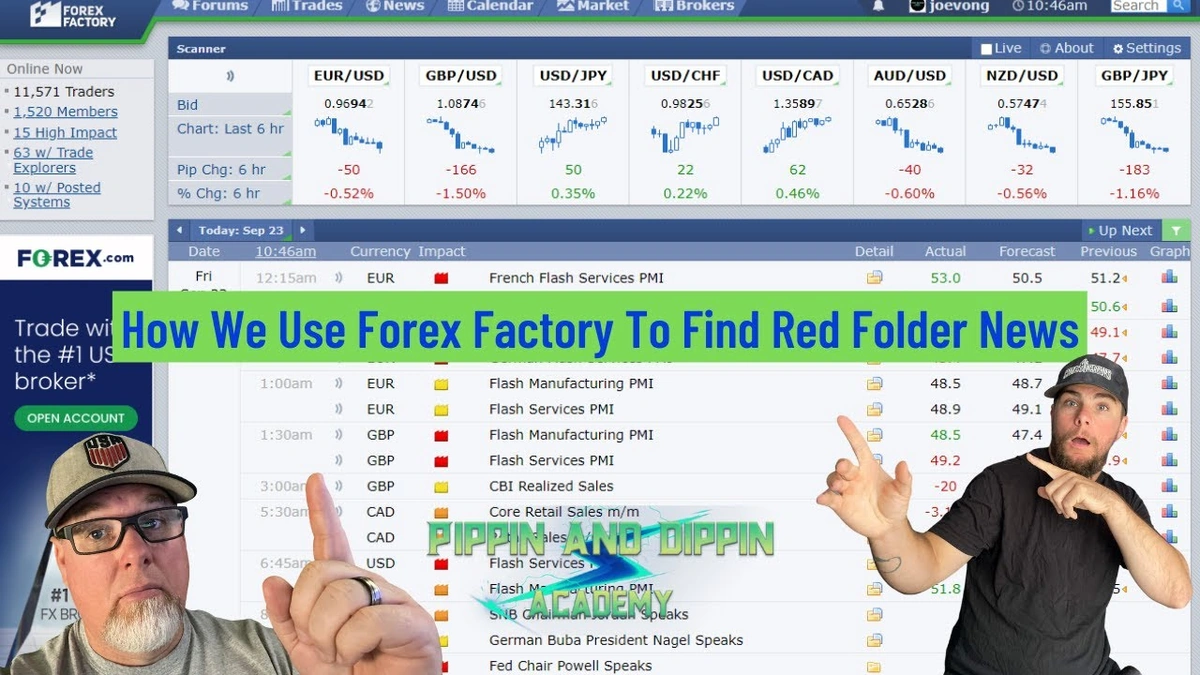

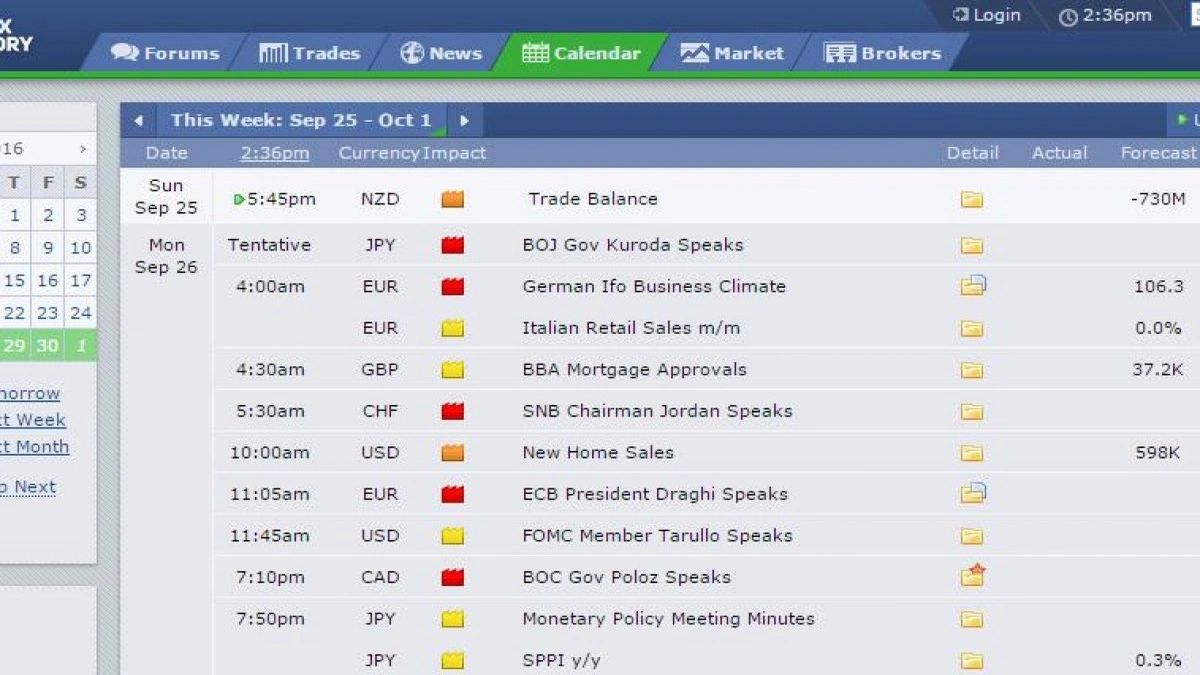

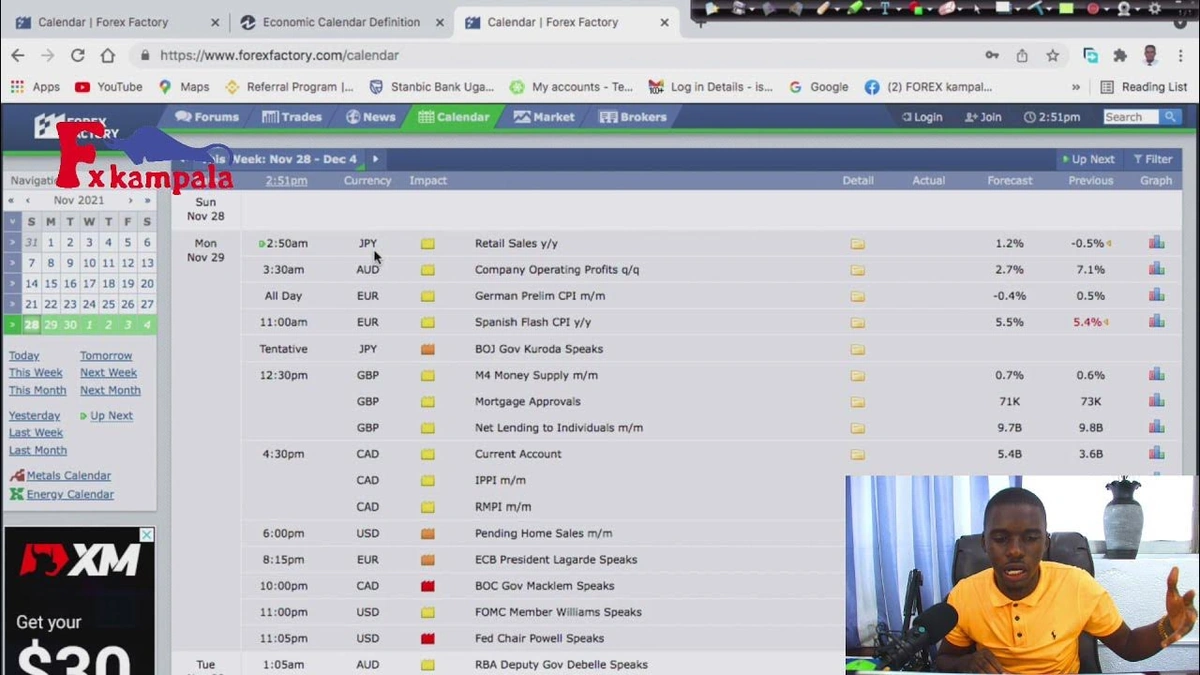

Understanding the Forex Factory Economic Calendar

The heart of Forex Factory is its economic calendar . It lists upcoming economic events from around the globe – things like GDP releases, inflation data, and employment figures. But simply knowing the event is happening isn’t enough. It’s about anticipating the impact.

So, how do you do that? Well, first, pay attention to the “Impact” column. This is Forex Factory’s assessment of how significant the news release is likely to be. High impact events (usually marked in red) are the ones that can really move the market. Think of it as the difference between a pebble dropping in a pond (low impact) versus a boulder (high impact).

Currency strength also needs to be considered. High impact news from the US, for example, can send ripples across all currency pairs involving the dollar. And if you’re trading INR pairs, that’s something you definitely need to watch.

The “Why” | Unpacking the Implications for Your Trades

Let’s take an example. Say the US Federal Reserve announces an interest rate hike. What does that mean for you, sitting in India, trading USD/INR? Well, typically, a rate hike strengthens the dollar. That’s because higher interest rates attract foreign investment. So, if you’re holding a long position on USD/INR (meaning you’re betting the dollar will go up against the rupee), this is good news.

But – and this is a big ‘but’ – the market has already priced this in.

That’s where the “Actual” vs. “Forecast” numbers come in. If the actual rate hike is higher than forecast, the dollar might surge even further. But if it’s lower, or even just as expected, you might see a “buy the rumour, sell the news” reaction, where the dollar actually falls. This is the nuance many traders miss.

This connects to stock market holidays , as thin liquidity during holidays can amplify these reactions.

I initially thought understanding economic indicators would be straightforward, but then I realized how much the market anticipates and discounts. Don’t just look at the numbers; understand the market’s expectations.

The “How” | Actionable Strategies for Indian Traders

Okay, so you understand the calendar and the potential impact. Now, how do you actually use this information to make better trades? Here’s what I do:

- Pre-emptive Analysis: Before a major news release, I analyze the charts. What’s the trend? Where are the key support and resistance levels? This gives me a framework for understanding how the market might react.

- Risk Management: This is crucial, especially during volatile news events. I always use stop-loss orders to limit my potential losses. I’ve seen traders wiped out because they got greedy and didn’t manage their risk properly.

- Post-Release Observation: I don’t immediately jump into a trade right after the announcement. I wait for the market to digest the news and establish a clear direction. Trying to predict the initial knee-jerk reaction is often a recipe for disaster.

A common mistake I see people make is over-leveraging their positions before major news events. Remember, volatility can spike, and your broker might automatically close your positions if your margin is too low. Be smart, be patient, and trade responsibly. Don’t get caught up in market volatility .

Beyond the Numbers | The Importance of Sentiment Analysis

Forex Factory also has a forum section, which I find invaluable. It’s a great place to gauge market sentiment – what other traders are thinking and how they’re positioned. This can provide valuable clues about potential market movements.

However – and this is important – don’t blindly follow the crowd. Use the forum as a source of information, but always do your own analysis and make your own decisions. The biggest wins I’ve had came from going against the grain, when everyone else was panicking.

Another point to consider is the currency pair correlation . Knowing how different currency pairs move in relation to each other can help you diversify your risk and identify potential trading opportunities. For example, if you’re long on USD/INR and you see that USD/JPY is also trending upwards, it might give you more confidence in your USD/INR position.

Staying Updated with Forex News

Staying informed about global economic events and their potential impact is essential for successful trading. This includes monitoring forex factory news and understanding their implications for the market. You can also find more information on energy shares .

FAQ | Forex Factory News for Indian Traders

What exactly is Forex Factory?

It’s a website that provides news, calendars, and tools for forex traders. Think of it as a one-stop shop for all things forex.

Is Forex Factory news reliable?

Generally, yes. They source their data from reputable sources. However, always cross-reference with other sources before making trading decisions.

How can I use the Forex Factory calendar effectively?

Pay attention to the “Impact” column, compare the “Actual” vs. “Forecast” numbers, and understand the market’s expectations.

What if I don’t understand all the economic terms?

Don’t worry! There are tons of resources online that explain these terms in plain English. Google is your friend!

Is Forex Factory completely free?

Yes, the core features (calendar, news, forums) are free. Some third-party tools might require a subscription.

What are the alternatives to Forex Factory?

Bloomberg, Reuters, and DailyFX are also popular sources for forex news and analysis.

What fascinates me is how much of forex trading is psychology. It’s not just about the numbers; it’s about understanding how other traders think and react. Forex Factory can give you an edge, but ultimately, your success depends on your discipline, risk management, and analytical skills.