Decoding the New GST Rates for Cars | What It Means for You

So, the new GST rates for cars are out. But here’s the thing: it’s not just about a number changing. It’s about understanding the ripple effect this has on the Indian auto market and, more importantly, your wallet. What fascinates me is how these seemingly small tweaks can influence big decisions. Let’s dive in, shall we? Consider this your friendly guide to navigating this automotive tax maze. We will consider how the GST council decision affects you.

Thank you for reading this post, don't forget to subscribe!The ‘Why’ Behind the Rate Revision

Often, we just see the headlines: “GST rates revised!” But, why now? What’s driving this? Well, it’s rarely a simple answer. Government policy shifts, economic fluctuations, and even global market pressures all play a role. The GST council, responsible for these changes, aims to strike a balance – boosting revenue while keeping the auto sector competitive. It’s a tightrope walk, to be honest. Changes on BP India Energy also highlight the rapidly shifting energy sector. Think of it like this: the government is trying to fine-tune the engine of the Indian economy, and sometimes that means adjusting the fuel mix (in this case, taxes). The impact on car prices is also something we can consider.

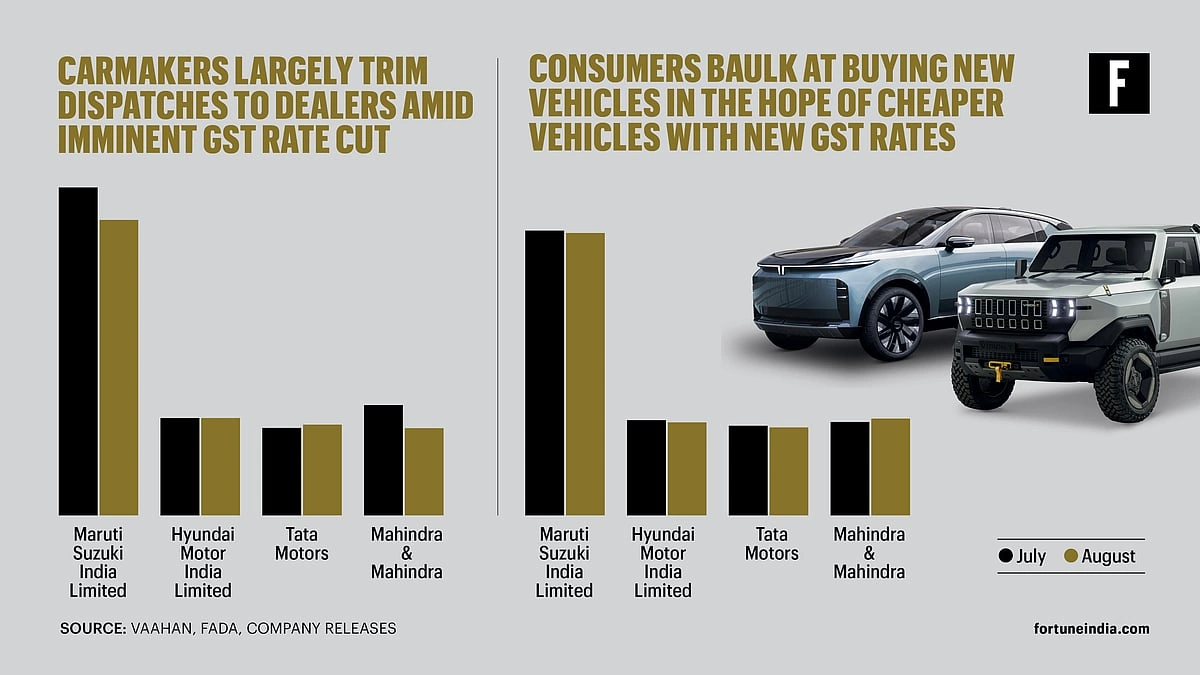

And let’s be real, the automotive industry is a significant contributor to the Indian economy. So, any change in its tax structure will have a cascading effect. From manufacturers and dealerships to individual buyers like you and me, everyone feels the pinch (or the relief!).

Decoding the Numbers | A Practical Guide

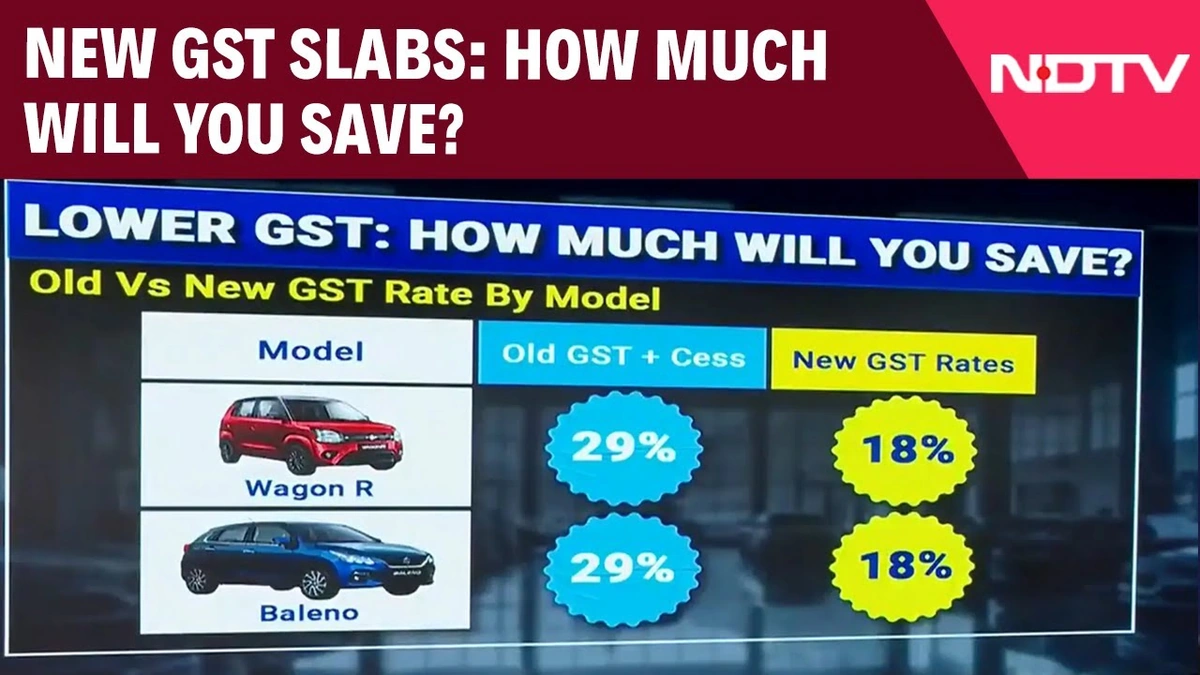

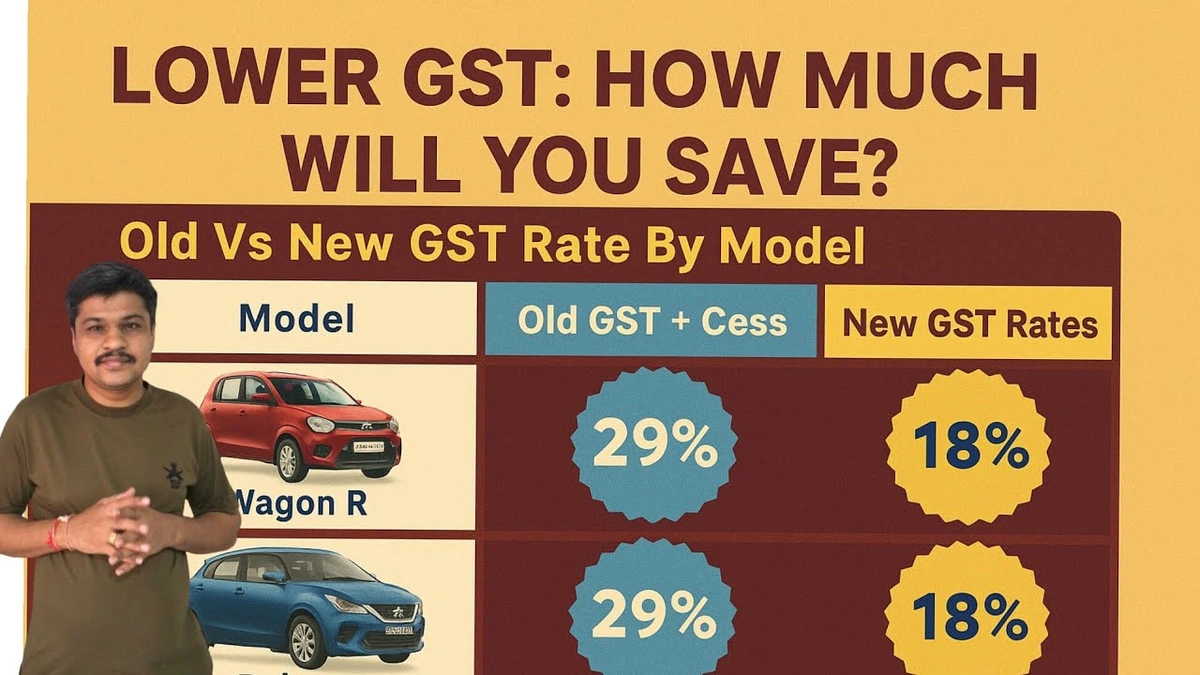

Okay, enough with the high-level stuff. Let’s get down to brass tacks. What are the actual revised GST rates ? And how does it break down for different types of vehicles? This is where it can get a little confusing, so bear with me. The GST on cars varies based on factors like engine capacity, vehicle size, and fuel type. Small cars typically attract a lower rate than luxury SUVs, for example. Electric vehicles (EVs), on the other hand, often enjoy preferential rates to encourage adoption. It’s worth checking the latest official notifications for the most up-to-date information, as rates can fluctuate. And a GST rate comparison can also be done.

A common mistake I see people make is assuming that the sticker price is the final price. Don’t forget to factor in other charges like registration fees, road tax, and insurance. These can significantly bump up the total cost. Always ask for a detailed break-up from the dealer to avoid any surprises.

The Emotional Rollercoaster | Buying a Car in a Changing Tax Landscape

Let’s be honest, buying a car is a big emotional decision. It’s not just about getting from point A to point B; it’s about status, freedom, and sometimes, even a little bit of showing off. And when you throw in fluctuating car taxation policy , it can feel like navigating a minefield. That moment of excitement when you find the perfect car can quickly turn to anxiety when you start crunching the numbers. What if the rates change again next month? Am I getting the best deal? These are valid concerns. The goal of the government is to support automotive industry but how well are they doing?

But, here’s my advice: don’t let the fear of the unknown paralyze you. Do your research, talk to multiple dealers, and get everything in writing. And remember, a car is a depreciating asset. So, focus on finding a vehicle that meets your needs and budget, rather than chasing the absolute lowest price. The long-term value is in enjoying the ride, not just saving a few bucks upfront.

EVs and GST | A Greener Path Forward

Speaking of enjoying the ride, let’s talk about electric vehicles. The government is keen on promoting EVs, and one of the ways they’re doing this is through lower GST rates. EVs generally attract a lower GST compared to petrol or diesel cars. This is a deliberate move to encourage consumers to switch to cleaner modes of transportation. While the initial cost of an EV might be higher, the lower running costs and tax benefits can make it a compelling option in the long run. As per the Reliance AGM , there is also an increase in renewable energies.

However, the EV landscape in India is still evolving. Charging infrastructure is still limited, and range anxiety is a real concern for many potential buyers. But, as technology improves and charging networks expand, EVs are poised to become a more mainstream choice. So, keep an eye on this space. The impact of gst on vehicle price is always on people’s minds.

The Future of Car Taxes | What to Expect?

Predicting the future is always tricky, especially when it comes to government policy. However, it’s safe to say that the GST on automobile sector will continue to evolve. As the Indian economy grows and the automotive industry matures, we can expect further refinements to the tax structure. The government will likely continue to use taxes as a tool to influence consumer behavior, promoting EVs and discouraging polluting vehicles. So, staying informed and adaptable is key. And perhaps we can even see a lower cess on luxury cars .

Ultimately, the goal is to create a tax system that is fair, transparent, and conducive to economic growth. Whether that goal is actually achieved remains to be seen. But one thing is certain: the journey will be full of twists and turns. Buckle up!

FAQ | Your GST on Cars Questions Answered

What if I’m buying a used car? Are GST rates different?

Yes, GST rates on used cars are generally lower than those on new cars. The exact rate depends on the age and type of the vehicle.

Are there any GST exemptions for people with disabilities?

Yes, certain vehicles modified for use by people with disabilities may be eligible for GST exemptions. You’ll need to provide the necessary documentation to claim the exemption.

How often do GST rates on cars change?

GST rates can be revised periodically by the GST Council. There’s no fixed schedule, so it’s best to stay updated on the latest announcements.

Where can I find the most accurate and up-to-date information on GST rates?

The official website of the Central Board of Indirect Taxes and Customs (CBIC) is the best source for accurate and up-to-date information.

So, there you have it – a deep dive into the world of GST rates for cars in India. It’s a complex topic, but hopefully, this has shed some light on the key issues. Remember, knowledge is power. And in the world of car buying, a little bit of knowledge can save you a lot of money (and headaches!).