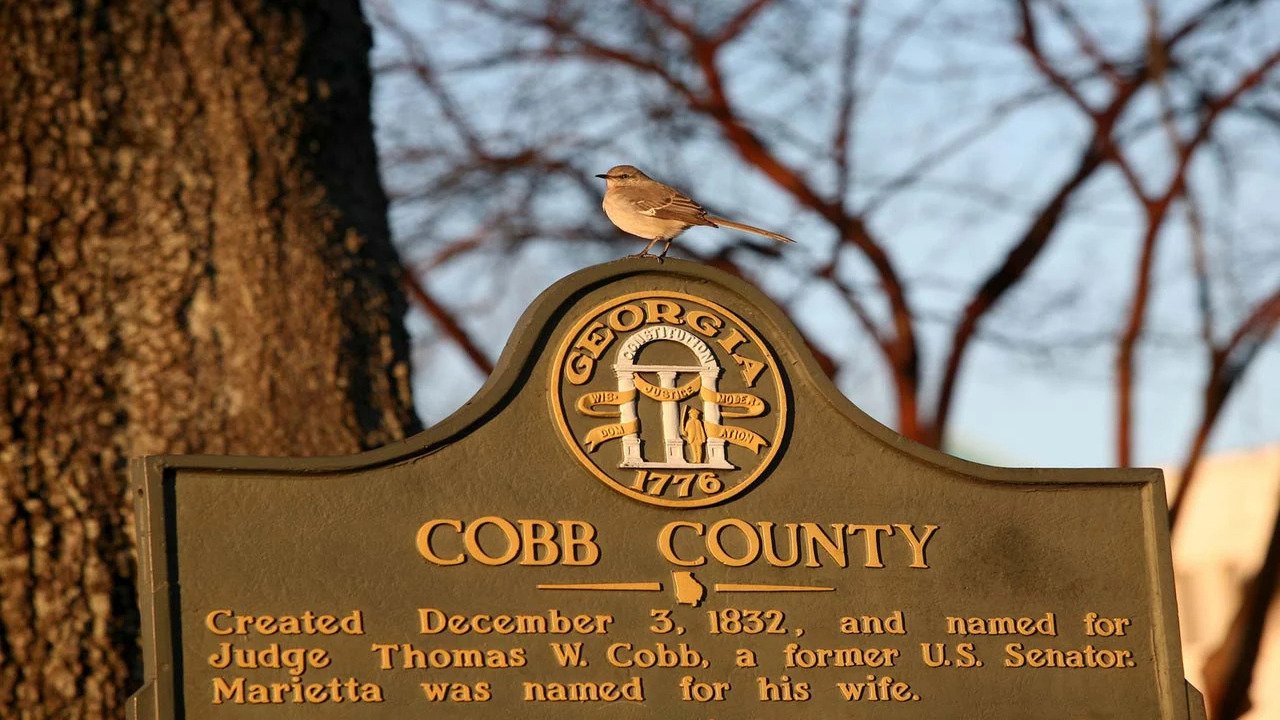

Cobb County Tax Assessor :Property Info & Updates 2025.

Cobb County Tax Assessor an independent body appointed by the Board of Commissioners, plays a critical role in ensuring fair and equitable property valuations for the county’s taxpayers. Responsible for assessing all taxable property, including residential, commercial, and personal property, the Board strives to provide accurate valuations while offering excellent customer service. In 2025, several updates and tools have been introduced to enhance transparency and accessibility for property owners. This article provides a comprehensive guide to the Cobb County Tax Assessor property information services, key updates for 2025, and actionable steps for taxpayers.

Thank you for reading this post, don't forget to subscribe!Role of the Cobb County Tax Assessor

The Board of Tax Assessors is tasked with determining the fair market value of all taxable property in Cobb County as of January 1 each year, in accordance with Georgia state law. This valuation, known as the assessed value, forms the basis for ad valorem (property) taxes, calculated as 40% of the fair market value multiplied by the millage rate set by the Board of Commissioners. The Board does not collect taxes—that responsibility falls to the Cobb County Tax Commissioner—but ensures that valuations are equitable and reflective of current market conditions. The Tax Assessor’s office also handles exemptions, appeals, and property data management.

Accessing Property Information in 2025

Cobb County Tax Assessor offers robust online tools to help property owners access detailed information about their properties, recent sales, and tax assessments. These tools are designed to empower taxpayers with the data needed to understand their valuations and make informed decisions about appeals or exemptions.

Key Online Resources

- Assessor.cobbcounty.gov: The official website of the Cobb County Tax Assessor, which moved to the .GOV domain in 2025, replacing the former Cobbassessor.org. This site provides access to property records, assessment notices, appeal forms, and exemption applications.

- qPublic Portal: An external platform (qpublic.schneidercorp.com) offering maps, real estate data, tax information, and appraisal records for Cobb County properties. This tool is ideal for researching property details and comparable sales.

- GIS Property Search: Available at gis.cobbcounty.org, this tool allows users to search property records by entering the house number and street name (e.g., 100 Cherokee Street). It provides detailed data on property characteristics and ownership.

- Tax Estimator: Found at cobbtax.gov, this tool enables property owners to estimate their 2025 property taxes based on the latest millage rates and assessed values. It is particularly useful for new homeowners or those who received a recent assessment notice.

To access property information, visit Assessor.cobbcounty.gov, enter your parcel ID or address, and review details such as square footage, number of bedrooms/bathrooms, and recent sales data. For errors in property records (e.g., incorrect square footage), contact the Tax Assessor’s office at (770) 528-3100 or cobbtaxassessor@cobbcounty.gov.

Key Updates for 2025

Several developments in 2025 impact property owners in Cobb County, from changes in the tax digest to new tools and procedures. Below are the most significant updates:

Modest Tax Digest Growth

The Cobb County Tax Assessorhas projected a 2% increase in the 2025 tax digest, a significant slowdown from the 8.52% increase in 2024. This reflects a cooling real estate market, with the average home sales price rising by only $20,000 in 2024 to nearly $500,000, compared to a $50,000 increase two years prior. Fewer properties will see reassessments in 2025, and valuation increases are expected to be lower, reducing the likelihood of significant tax hikes for most homeowners.

Website Transition to .GOV Domain

In 2025, Cobb County completed its transition to the .GOV domain for enhanced security and credibility. The Tax Assessor’s website is now Assessor.cobbcounty.gov, and all email communications use @cobbcounty.gov addresses. Property owners should update their records to reflect these changes when contacting the office.

Property Tax Appeal Process Enhancements

The Tax Assessor’s office continues to refine its appeal process to assist taxpayers. In 2025, property owners can file appeals if they believe their assessed value is too high, contains factual errors, or is non-uniform compared to similar properties. The appeal deadline is 45 days from the mailing date of the annual assessment notice, typically sent before July 1. Appeals can be filed online at Assessor.cobbcounty.gov or mailed to P.O. Box 649, Marietta, GA 30061, with a U.S. Postal Service postmark by the deadline. Options include:

- Board of Equalization (BOE): A free hearing before a panel of local property owners.

- Arbitration: A faster but costlier option requiring a certified appraiser.

- Hearing Officer: For non-homestead properties valued over $750,000.

To strengthen an appeal, gather evidence such as recent sales data (within 6–12 months of January 1, 2025) from Assessor.cobbcounty.gov, Zillow, or Redfin, and document any property condition issues (e.g., deferred maintenance) with photos or repair estimates.

Homestead Exemption Deadline

The deadline to apply for homestead exemptions for the 2025 tax year was April 1, 2025. Homeowners who purchased and occupied their primary residence before January 1, 2025, but missed the deadline can apply for 2026. Exemptions reduce taxable value, potentially saving hundreds annually. Applications are processed through the Tax Commissioner’s office at cobbtax.gov or in person at 736 Whitlock Avenue, Marietta.

Business Personal Property Tax Changes

For businesses, the Composite Conversion Factors on Schedule A of the Business Personal Property Tax Return have changed for 2025. Companies must use updated forms and factors when filing returns, due by April 1, 2025, to avoid penalties. Contact the Tax Assessor’s office for the latest forms.

Property Tax Calculation and Payment

Property taxes in Cobb County are calculated using the formula: (Fair Market Value × 0.4) × (Millage Rate ÷ 1,000). For example, a home with a fair market value of $500,000 and a millage rate of 20 mills would have a tax of ($500,000 × 0.4) × (20 ÷ 1,000) = $4,000. Tax bills are mailed by August 15 and due by October 15, 2025. Payments can be made online at cobbtax.gov, by mail to P.O. Box 100127, Marietta, GA 30061, or in person at locations like 736 Whitlock Avenue or 4700 Austell Road, Austell. Late payments incur penalties, and metered or kiosk postmarks are not accepted.

For properties within city limits (e.g., Marietta, Smyrna), owners receive separate city tax bills, as cities handle their own billing. Check with your city’s tax office for details.

2025 Tax Digest Breakdown

The table below summarizes the 2025 tax digest and its implications for property owners.

| Category | Details | Impact |

|---|---|---|

| Tax Digest Growth | 2% increase, down from 8.52% in 2024. | Fewer reassessments, lower average valuation increases. |

| Average Home Price | $500,000 (up $20,000 from 2024). | Modest tax increases for most homeowners. |

| Assessment Date | January 1, 2025. | Valuations reflect property condition and sales data as of this date. |

| Appeal Deadline | 45 days from assessment notice (typically before mid-August). | Timely filing critical to challenge valuations. |

| Homestead Exemption Deadline | April 1, 2025 (for 2025 tax year). | Missed deadlines apply to 2026. |

Tips for Property Owners

- Review Your Assessment Notice: Check for errors in property details (e.g., square footage, features) and compare your valuation to recent sales in your neighborhood.

- File Appeals Promptly: Use online tools to gather comparable sales data and submit appeals by the 45-day deadline. Attend information sessions (e.g., at East Cobb Library) for guidance.

- Apply for Exemptions: If eligible, apply for homestead or other exemptions to reduce your taxable value. Contact the Tax Commissioner at (770) 528-8600 for assistance.

- Monitor Tax Bills: Ensure payments are postmarked by October 15, 2025, to avoid penalties. Use the Tax Estimator for budgeting.

- Stay Informed: Regularly check Assessor.cobbcounty.gov for updates on site visits, digest reports, and appeal procedures.

Frequently Asked Questions

1. What does the Cobb County Tax Assessor do?

The Cobb County Tax Assessor is responsible for valuing all real and personal property for tax purposes, ensuring fair and accurate assessments across the county.

2. How can I find my property value in Cobb County?

You can search your property by address or parcel number on the Cobb County Tax Assessor’s website to view current valuations, ownership details, and tax history.

3. How often are property assessments updated in Cobb County?

Property assessments in Cobb County are typically updated annually to reflect changes in market value, new construction, or property improvements.

4. Can I appeal my property assessment in 2025?

Yes, property owners can file an appeal within 45 days of receiving their assessment notice if they believe their property has been overvalued.

5. How do I contact the Cobb County Tax Assessor’s office?

You can contact the office through their official website, by phone, or by visiting in person at the Cobb County Government building.